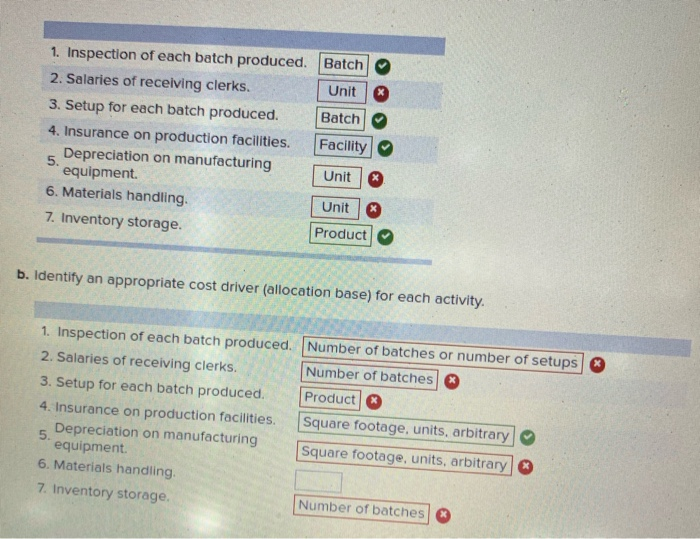

Question: be clear please 1. Inspection of each batch produced. Batch 2. Salaries of receiving clerks. Unit 3. Setup for each batch produced. Batch 4. Insurance

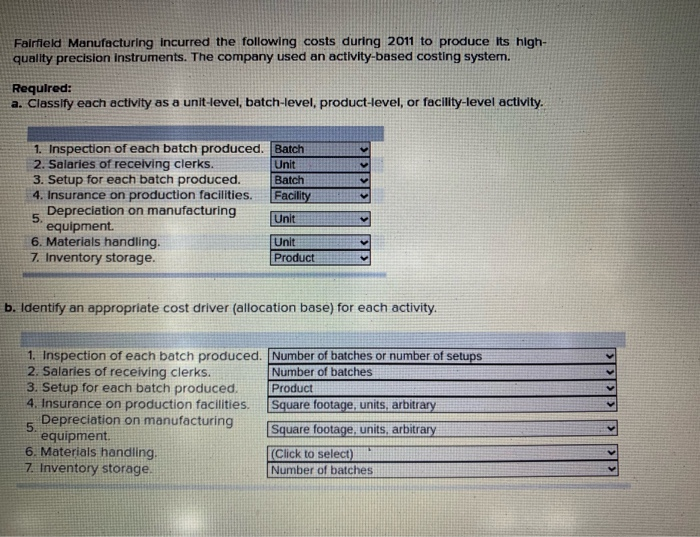

1. Inspection of each batch produced. Batch 2. Salaries of receiving clerks. Unit 3. Setup for each batch produced. Batch 4. Insurance on production facilities. Facility Depreciation on manufacturing 5. Unit equipment 6. Materials handling. Unit 7. Inventory storage. Product b. Identify an appropriate cost driver (allocation base) for each activity. 1. Inspection of each batch produced. Number of batches or number of setups 2. Salaries of receiving clerks. Number of batches 3. Setup for each batch produced Product 4. Insurance on production facilities. Square footage, units, arbitrary Depreciation on manufacturing Square footage, units, arbitrary equipment 6. Materials handling. 7. Inventory storage. Number of batches 5. Fairfield Manufacturing incurred the following costs during 2011 to produce its high- quality precision instruments. The company used an activity-based costing system. Required: a. Classify each activity as a unit-level, batch-level, product-level, or facility-level activity. 1. Inspection of each batch produced. Batch 2. Salaries of receiving clerks. Unit 3. Setup for each batch produced. Batch 4. Insurance on production facilities. Facility Depreciation on manufacturing 5. Unit equipment. 6. Materials handling. Unit 7. Inventory storage. Product b. Identify an appropriate cost driver (allocation base) for each activity. 1. Inspection of each batch produced. Number of batches or number of setups 2. Salaries of receiving clerks. Number of batches 3. Setup for each batch produced. Product 4. Insurance on production facilities. Square footage, units, arbitrary Depreciation on manufacturing Square footage, units, arbitrary equipment 6. Materials handling. (Click to select) 7. Inventory storage. Number of batches 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts