Question: Problem 12-3 Statement of Cash Flows - Direct Method Problem 12-4 Statement of Cash Flows - Indirect Method 2. Using the format in of cash

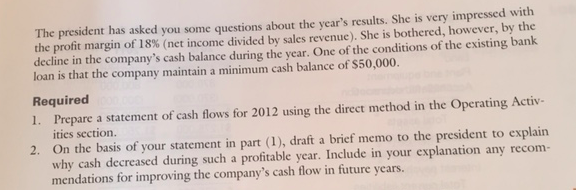

Problem 12-3 Statement of Cash Flows - Direct Method

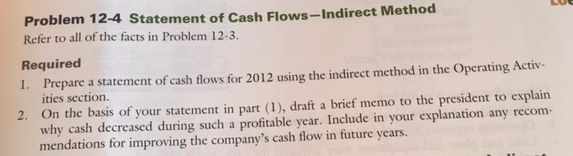

Problem 12-4 Statement of Cash Flows - Indirect Method

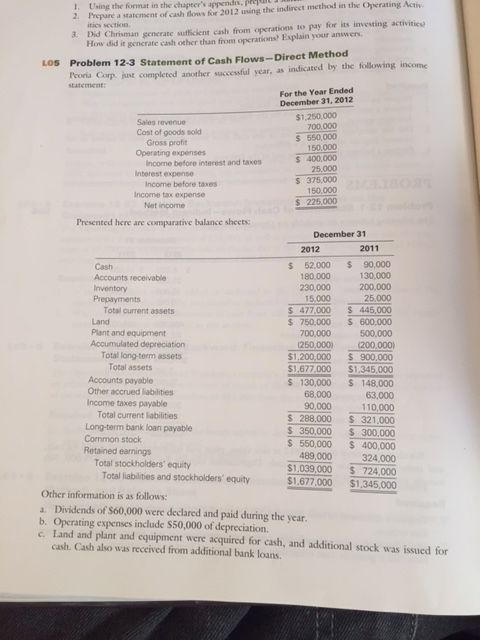

2. Using the format in of cash flows for 2012 using the indirect method in I. Prepare a statement the the Operating Activ. Operating Activ 3 Did Chrisman generate suficient cash from operations to pay for its investing activities? How did it generate cash other than from operations? Esplain your answers. Los Problem 12-3 statement of cash Flows Direct Method income Peoria Corp. just completed another succesful year, as indicated the following For the Year Ended December 31, 2012 $1.250.000 Cost of goods sold 400,000 Income before interest and taxes S 375,000 Income tax expense Presented here are comparative balance sheets: 31 2011 2012 s 52.000 90.000 130,000 230.000 200,000 25,000 15,000 445,000 Total current assets 477.000 750.000 600,000 500,000 (250,000) (200.000) Total long-term assets 900,000 Total assets $1,677,000 $1,345,000 130,000 148,000 Other accrued liabilities 63.000 Total current liabilities 288.000 321.000 Long-term bank loan payable 350,000 300.000 550,000 400,000 324.000 Total stockholders' equity $1.039,000 724,000 Total liabilities and stockholders' equity $1.677,000 $1,345,000 Other information is as follows: a. Dividends of S60,000 were declared and paid during the year. b. expenses include S50,000 of depreciation. c. Land and plant and equipment were acquired for cash, and additional stock was issued for cash. Cash also was received from additional bank loans. 2. Using the format in of cash flows for 2012 using the indirect method in I. Prepare a statement the the Operating Activ. Operating Activ 3 Did Chrisman generate suficient cash from operations to pay for its investing activities? How did it generate cash other than from operations? Esplain your answers. Los Problem 12-3 statement of cash Flows Direct Method income Peoria Corp. just completed another succesful year, as indicated the following For the Year Ended December 31, 2012 $1.250.000 Cost of goods sold 400,000 Income before interest and taxes S 375,000 Income tax expense Presented here are comparative balance sheets: 31 2011 2012 s 52.000 90.000 130,000 230.000 200,000 25,000 15,000 445,000 Total current assets 477.000 750.000 600,000 500,000 (250,000) (200.000) Total long-term assets 900,000 Total assets $1,677,000 $1,345,000 130,000 148,000 Other accrued liabilities 63.000 Total current liabilities 288.000 321.000 Long-term bank loan payable 350,000 300.000 550,000 400,000 324.000 Total stockholders' equity $1.039,000 724,000 Total liabilities and stockholders' equity $1.677,000 $1,345,000 Other information is as follows: a. Dividends of S60,000 were declared and paid during the year. b. expenses include S50,000 of depreciation. c. Land and plant and equipment were acquired for cash, and additional stock was issued for cash. Cash also was received from additional bank loans

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts