Question: Problem 12-32 Merck & Co., Inc. ratios OBJECTIVES 3, 4 2. Compare the two companies by using the common size statements 12-32 Computation of Ratios

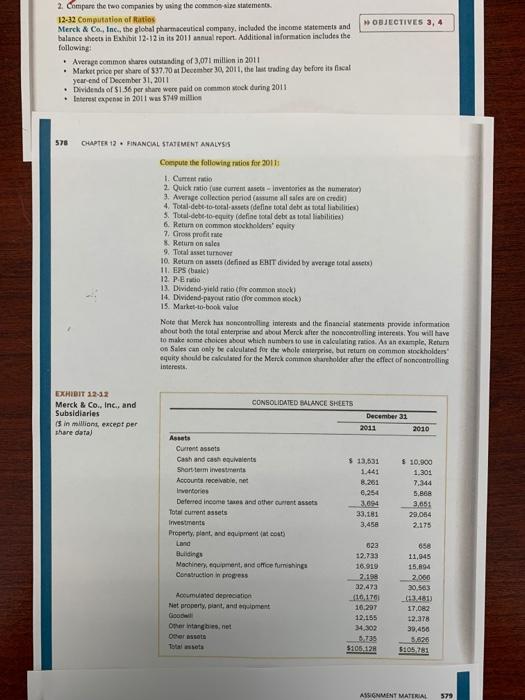

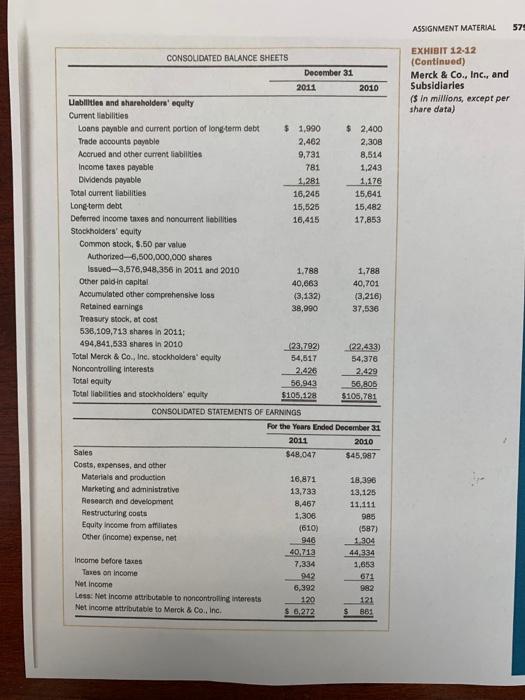

OBJECTIVES 3, 4 2. Compare the two companies by using the common size statements 12-32 Computation of Ratios Merck & Co., Inc., the global pharmaceutical company, included the income statements and balance sheets in Exhibit 12-12 in its 2011 annual report. Additional information includes the following: Average common shares outstanding of 3,07 million in 2011 Market price per share of 537.70 m December 30, 2011, the last trading day before its fiscal year end of December 31, 2011 Dividends of $156 per share were paid on common stock during 2011 Interest expens in 2011 was 5749 million 578 CHAPTER 12 FINANCIAL STATEMENT ANALYSS Compute the following ratios for 2011 1. Current ruti 2. Quick ratio (use current - Inventories as the numrator) 3. Average collection period (nume all sales are on credit) 4. Total-debt-to-total-sets define total debtas total liabilities) Total-debt-to-equity define total dels as total liabilities) 6. Return on common stockholders' equity 7. Gross profitne Return on sales 9. Tocal asset turnover 10. Return on es defined as EBIT divided by wenye totalet) 11. EPS (basic) 12 PE 13. Dividend-yield ratio (for common stock) 14. Dividend payout ratio for common ock) 15. Market-to-book value Note that Merck Boncorolling interests and the financial statements provide information about both the total enterprise and about Merek her the no controlling interests. You will have to make some choices about which numbers to use in calculating ratios. As an example, Return on Sales can only be calculated for the whole enterprise, but return on common stockholders equity should be called for the Merck comic shareholder after the effect of noncontrolling imeres CONSOLIDATED MLANCE SHEETS EXHIBIT 12:32 Merck & Co., Inc., and Subsidiaries sin millions except per share data) December 31 2011 2010 Assets Current assets Cash and cash valents Short term investments Accounts receivable net Inventories $ 13,031 $10.900 8.261 1,303 7.344 6,254 5,868 Deferred income thes and other current assets 2014 33,181 3,651 29.054 Total current assets Investments 3,450 2.175 Property, plant, and equipment to Land 023 Buildings Machinery, upent, and oceturnishing Construction process 12.733 16.919 2-100 32,473 10.170 10,297 12.155 658 11,945 15.894 2.000 30.563 111.4813 17.082 Acumulated deprecation Net property, plant, and ment Good Orer hangie net er assets 12,378 99,450 34,302 Total asset 6.735 5105,128 $165281 ANGNMENT MATERIAL 579 ASSIGNMENT MATERIAL 574 CONSOLIDATED BALANCE SHEETS December 31 EXHIBIT 12-12 (Continued) Merck & Co., Inc., and Subsidiaries (s in millions, except per share data) 2011 2010 Uabilities and shareholders' equity Current liabilities Loans paynble and current portion of long term debt Trade accounts payable Accrued and other current liabilities Income taxes payable Dividends payable $ 1,990 2.462 9,731 $ 2.400 2,308 8,514 1,243 781 1281 Total current liabilities 16,245 1.176 15,641 15,482 15.525 16,415 17.853 Long-term debt Deferred income taxes and noncurrent liabilities Stockholders' equity Common stock, 9.50 par value Authorized 6,500,000,000 shares Issued-3,576,948.356 in 2011 and 2010 Other poldin capital Accumulated other comprehensive loss Retained earnings Treasury stock, at cost 536,109,713 shares in 2011; 1.788 1.788 40,663 40.701 (3,132) 13,216) 38,990 37.536 494.841,533 shares in 2010 (22,433) 54.376 Total Merck & Co., Inc. stockholders' equity Noncontrolling interests Total equity Total liabilities and stockholders equity (23.792) 54,517 2.426 56,943 2.429 56.805 $106,781 $105,128 CONSOLIDATED STATEMENTS OF EARNINGS For the Year Ended December 31 2011 2010 Sales $48.047 $45.987 16,871 18,396 13,125 13,733 Costs, expenses, and other Materials and production Marketing and administrative Research and development Restructuring costs Equity income from affiliates Other income) expense.net 8,467 11.111 1,306 985 Income before taxes (610) 940 40,712 7.334 942 6,392 120 $ 0.272 (587) 1.904 44 334 1.653 671 982 Taxes on income Not Income Less: Net Income attributable to noncontrolling interests Net income attributable to Merck & Co., Inc. 121 $38

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts