Question: Problem 12-37 (LO. 6, 7, 8) Money, Inc., a calendar year s corporation in Denton, Texas, has two unrelated shareholders, each owning 50% of the

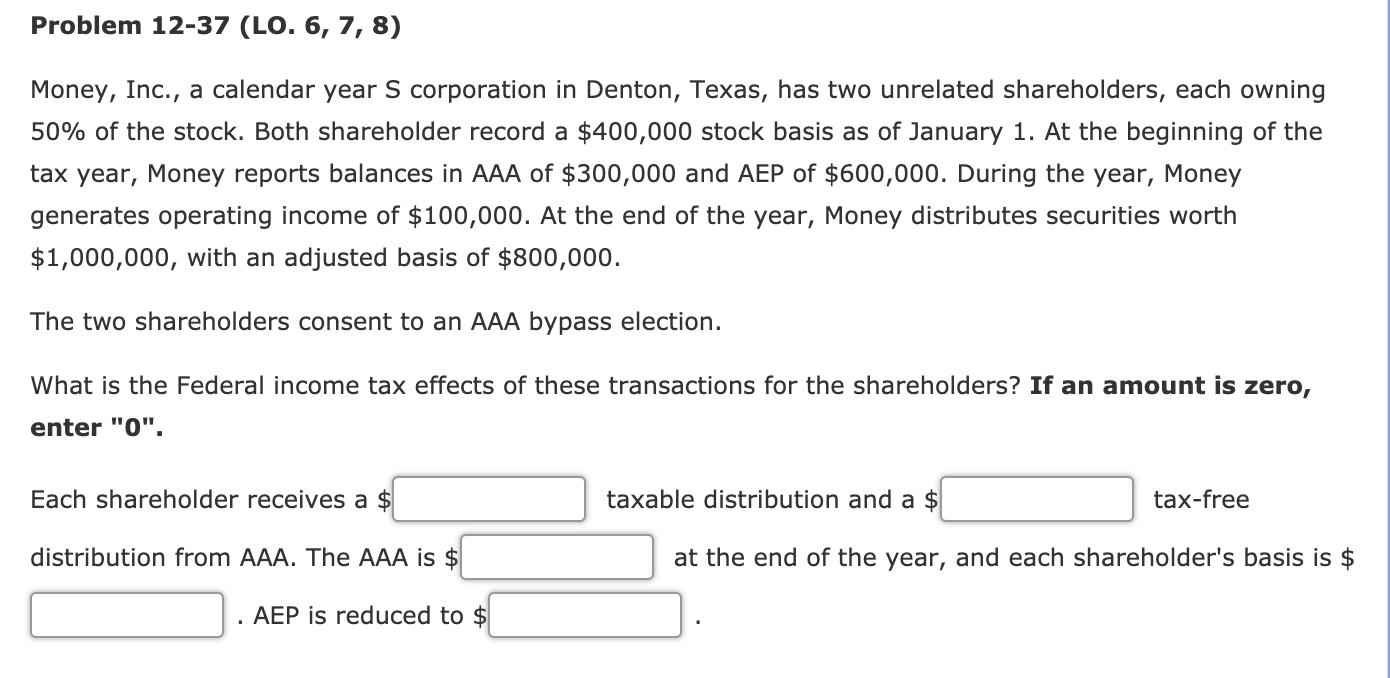

Problem 12-37 (LO. 6, 7, 8) Money, Inc., a calendar year s corporation in Denton, Texas, has two unrelated shareholders, each owning 50% of the stock. Both shareholder record a $400,000 stock basis as of January 1. At the beginning of the tax year, Money reports balances in AAA of $300,000 and AEP of $600,000. During the year, Money generates operating income of $100,000. At the end of the year, Money distributes securities worth $1,000,000, with an adjusted basis of $800,000. The two shareholders consent to an AAA bypass election. What is the Federal income tax effects of these transactions for the shareholders? If an amount is zero, enter "0" Each shareholder receives a $ taxable distribution and a $ tax-free distribution from AAA. The AA at the end of the year, and each shareholder's basis is $ - AEP is reduced to $L Problem 12-37 (LO. 6, 7, 8) Money, Inc., a calendar year s corporation in Denton, Texas, has two unrelated shareholders, each owning 50% of the stock. Both shareholder record a $400,000 stock basis as of January 1. At the beginning of the tax year, Money reports balances in AAA of $300,000 and AEP of $600,000. During the year, Money generates operating income of $100,000. At the end of the year, Money distributes securities worth $1,000,000, with an adjusted basis of $800,000. The two shareholders consent to an AAA bypass election. What is the Federal income tax effects of these transactions for the shareholders? If an amount is zero, enter "0" Each shareholder receives a $ taxable distribution and a $ tax-free distribution from AAA. The AA at the end of the year, and each shareholder's basis is $ - AEP is reduced to $L

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts