Question: Problem 12-44 Net Present Value, Uncertainty 4 Objective 1, 3 Ondi Airlines is interested in acquiring a new aircraft to service a new route. The

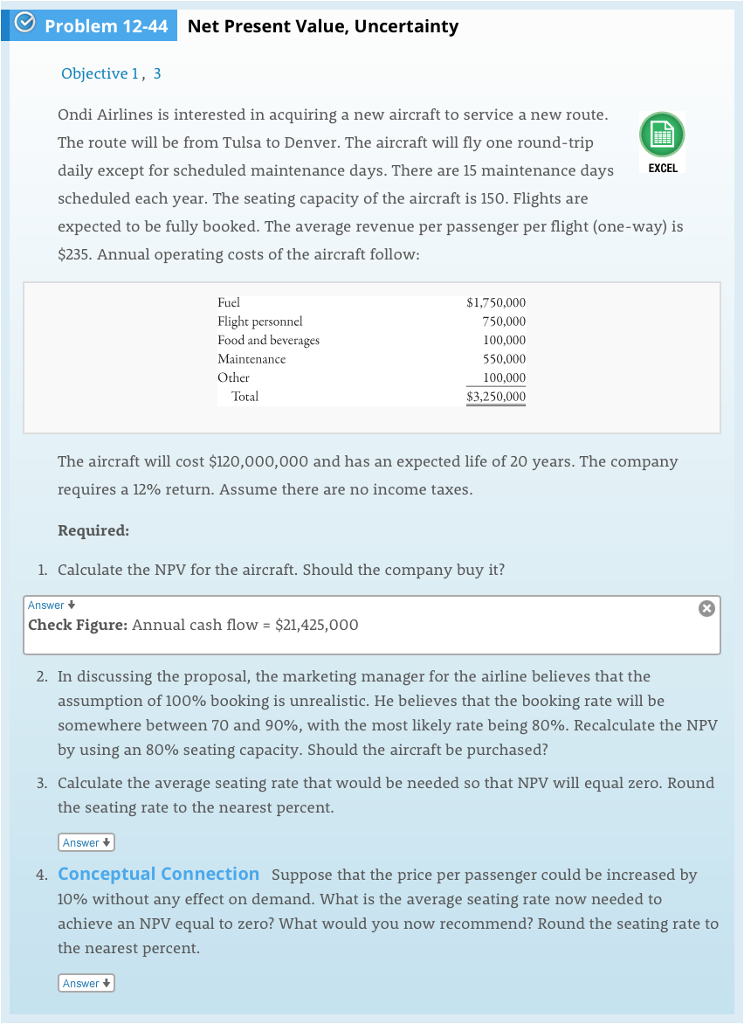

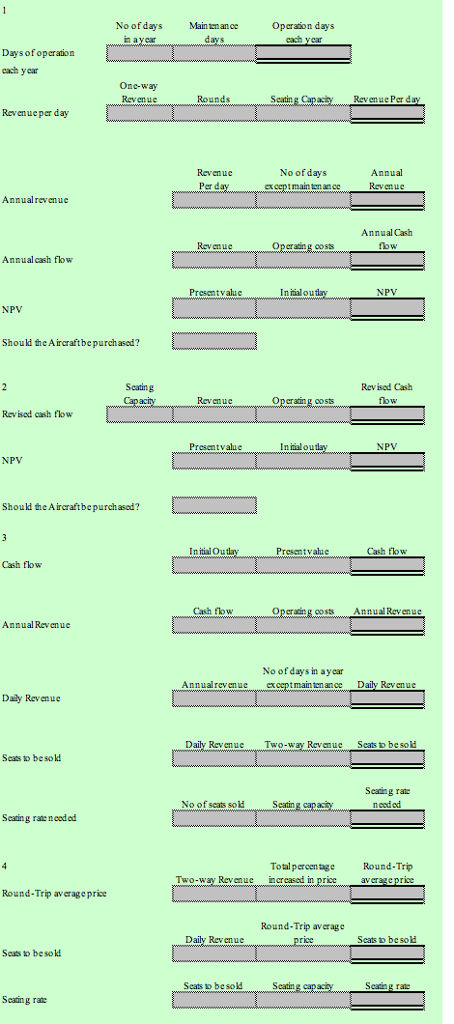

Problem 12-44 Net Present Value, Uncertainty 4 Objective 1, 3 Ondi Airlines is interested in acquiring a new aircraft to service a new route. The route will be from Tulsa to Denver. The aircraft will fly one round-trip daily except for scheduled maintenance days. There are 15 maintenance days EXCEL scheduled each year. The seating capacity of the aircraft is 150. Flights are expected to be fully booked. The average revenue per passenger per flight (one-way) is $235. Annual operating costs of the aircraft follow: Fuel Flight personnel Food and beverages Maintenance Other $1,750,000 750,000 100,000 550,000 100,000 $3,250,000 Total The aircraft will cost $120,000,000 and has an expected life of 20 years. The company requires a 12% return. Assume there are no income taxes. Required 1 Calculate the NPV for the aircraft. Should the company buy it? Answer Check Figure: Annual cash flow $21,425,000 2. In discussing the proposal, the marketing manager for the airline believes that the assumption of 100% booking is unrealistic. He believes that the booking rate will be somewhere between 70 and 90%, with the most likely rate being 80%. Recalculate the NPV by using an 80% seating capacity. Should the aircraft be purchased? 3. Calculate the average seating rate that would be needed so that NPV will equal zero. Round the seating rate to the nearest percent. Answer 4. Conceptual Connection Suppose that the price per passenger could be increased by 10% without any effect on demand, what is the average seating rate now needed to achieve an NPV equal to zero? What would you now recommend? Round the seating rate to the nearest percent. Answer No of days in a ycar Maintenance Operaion days cach ycr Daysof operation cach ycar One-way Reven uc Rounds Scatin Rev enue Per day Revenueper day Revenue Per d No of days exceptmain ten ance Annual Reven ue Annual revenue Annual Cash Reven uc Annual cash fhw Presentvalue Iniialou NPV NPV Shouki the Aircraftbe purch ased? Seating Revised Cash Revenue Revised cash fow Presentvalue Iniialou NPV NPV Shoud the Aircraftbepurchasad? Initial Ou Presentvalue Cash fow Cash flow crating costs Annual Rev nu Annual Revenue No of days in aycar Annualrevenue except main tenance Daily Revenue Daily Revenue Daily Revenue Two-way Revenue Scats to besoli Seats to besold Seaing rae n eod od No of seats sokd Scatin Scating rae ncoded Total percenage Round-Trip Two-way Revenue creased in price Round-Trip average price Round-Trip avcrage Daily Revenue Seats o besolt Seas to besold Seats to besod Seatin Searing rate Scating rae

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts