Question: Problem 12-6 CAPM and Valuation (L03) You are considering acquiring a firm that you believe can generate expected cash flows of $8,000 a year forever.

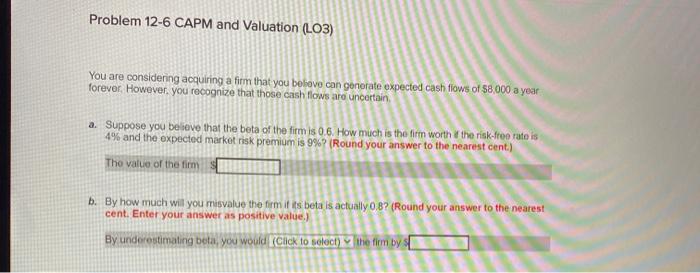

Problem 12-6 CAPM and Valuation (L03) You are considering acquiring a firm that you believe can generate expected cash flows of $8,000 a year forever. However, you recognize that those cash flows are uncertain a. Suppose you believe that the beta of the firm is 0.6. How much is the firm worth the risk-free rato 4% and the expected market risk premium is 9%? (Round your answer to the nearest cent) The value of the firms b. By how much will you misvalue the firm it is beta is actually 0,8? (Round your answer to the nearest cent. Enter your answer as positive value.) By underestimating beta, you would (Click to select the firm by

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock