Question: I cannot find the correct answer online, and I am unsure of what I am doing incorrectly. My method for calculating the WACC's seem to

I cannot find the correct answer online, and I am unsure of what I am doing incorrectly. My method for calculating the WACC's seem to be correct, but my answer I input is evidently wrong. I have uploaded what I inputted into excel.

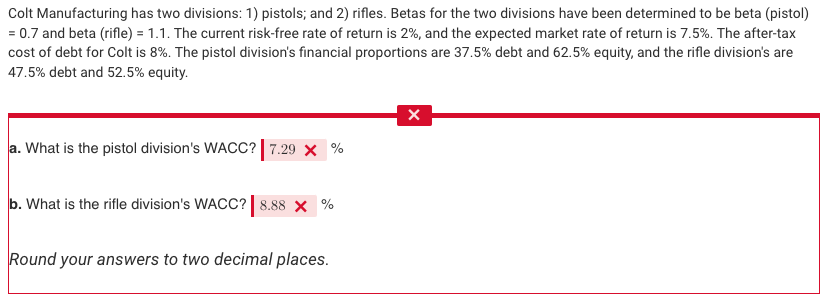

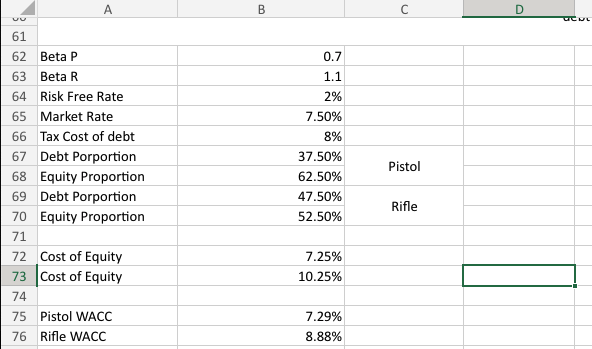

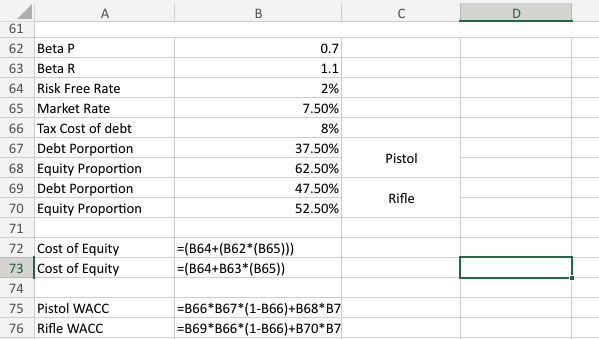

Colt Manufacturing has two divisions: 1) pistols; and 2) rifles. Betas for the two divisions have been determined to be beta (pistol) =0.7 and beta ( rifle )=1.1. The current risk-free rate of return is 2%, and the expected market rate of return is 7.5%. The after-tax cost of debt for Colt is 8%. The pistol division's financial proportions are 37.5% debt and 62.5% equity, and the rifle division's are 47.5% debt and 52.5% equity. a. What is the pistol division's WACC? % b. What is the rifle division's WACC? % \begin{tabular}{|c|c|c|c|c|} \hline & A & B & C & D \\ \hline \multicolumn{5}{|l|}{61} \\ \hline 62 & Beta P & 0.7 & & \\ \hline 63 & Beta R & 1.1 & & \\ \hline 64 & Risk Free Rate & 2% & & \\ \hline 65 & Market Rate & 7.50% & & \\ \hline 66 & Tax Cost of debt & 8% & & \\ \hline 67 & Debt Porportion & 37.50% & \multirow{2}{*}{ Pistol } & \\ \hline 68 & Equity Proportion & 62.50% & & \\ \hline 69 & Debt Porportion & 47.50% & \multirow{2}{*}{ Rifle } & \\ \hline 70 & Equity Proportion & 52.50% & & \\ \hline \multicolumn{5}{|l|}{71} \\ \hline 72 & Cost of Equity & =(B64+(B62(B65))) & & \\ \hline 73 & Cost of Equity & =(B64+B63(B65)) & & \\ \hline \multicolumn{5}{|l|}{74} \\ \hline 75 & Pistol WACC & =B66B67(1B66)+B68B7 & & \\ \hline 76 & Rifle WACC & =B69B66(1B66)+B70B7 & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline 4 & A & B & C & D \\ \hline \multicolumn{5}{|l|}{61} \\ \hline 62 & Beta P & 0.7 & & \\ \hline 63 & Beta R & 1.1 & & \\ \hline 64 & Risk Free Rate & 2% & & \\ \hline 65 & Market Rate & 7.50% & & \\ \hline 66 & Tax Cost of debt & 8% & & \\ \hline 67 & Debt Porportion & 37.50% & \multirow{2}{*}{ Pistol } & \\ \hline 68 & Equity Proportion & 62.50% & & \\ \hline 69 & Debt Porportion & 47.50% & \multirow{2}{*}{ Rifle } & \\ \hline 70 & Equity Proportion & 52.50% & & \\ \hline \multicolumn{5}{|l|}{71} \\ \hline 72 & Cost of Equity & 7.25% & & \\ \hline 73 & Cost of Equity & 10.25% & & \\ \hline \multicolumn{5}{|l|}{74} \\ \hline 75 & Pistol WACC & 7.29% & & \\ \hline 76 & Rifle WACC & 8.88% & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts