Question: Problem 13: Vortex Technologies Inc. is considering the expansion project that involves the purchase of new equipment. The cost of equipment is $350,000, and an

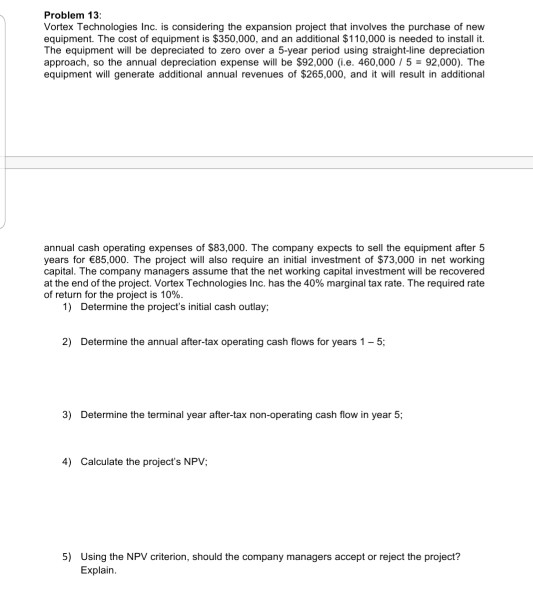

Problem 13: Vortex Technologies Inc. is considering the expansion project that involves the purchase of new equipment. The cost of equipment is $350,000, and an additional $110,000 is needed to install it. The equipment will be depreciated to zero over a 5-year period using straight-line depreciation approach, so the annual depreciation expense will be $92,000 (1.e. 460,000 / 5 = 92,000). The equipment will generate additional annual revenues of $265,000, and it will result in additional annual cash operating expenses of $83,000. The company expects to sell the equipment after 5 years for 85,000. The project will also require an initial investment of $73,000 in net working capital. The company managers assume that the networking capital investment will be recovered at the end of the project. Vortex Technologies Inc. has the 40% marginal tax rate. The required rate of return for the project is 10%. 1) Determine the project's initial cash outlay: 2) Determine the annual after-tax operating cash flows for years 1-5; 3) Determine the terminal year after-tax non-operating cash flow in year 5; 4) Calculate the project's NPV; 5) Using the NPV criterion, should the company managers accept or reject the project? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts