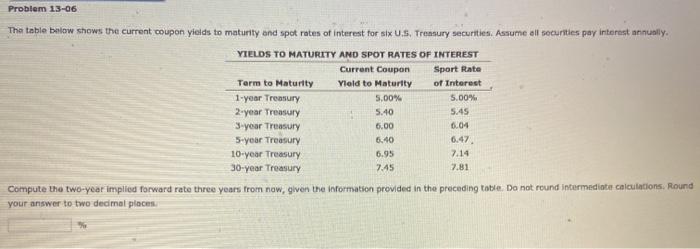

Question: Problem 13-06 Tha table below shows the current coupon yields to maturity and spot rates of interest for six U.S. Trensury securities. Assume all securities

Problem 13-06 Tha table below shows the current coupon yields to maturity and spot rates of interest for six U.S. Trensury securities. Assume all securities par interest annually. YIELDS TO MATURITY AND SPOT RATES OF INTEREST Current Coupon Sport Rate Tarm to Maturity Yield to Maturity of Interest 1-year Treasury 5.00% 5.00% 2-year Treasury 5.40 5.45 3-yoor Treasury 5.00 0.04 5-year Treasury 6.40 10-year Treasury 6.95 7.14 30-year Treasury 7.45 7.81 Compute the two-year implied forward rate three years from now, given the information provided in the preceding table. Do not round Intermediate calculations. Round your answer to two decimal places 6.47

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts