Question: Problem 1-30A (Static) Classifying events as asset source, use, or exchange LO 1-4, 1-6 The following unrelated events are typical of those experienced by business

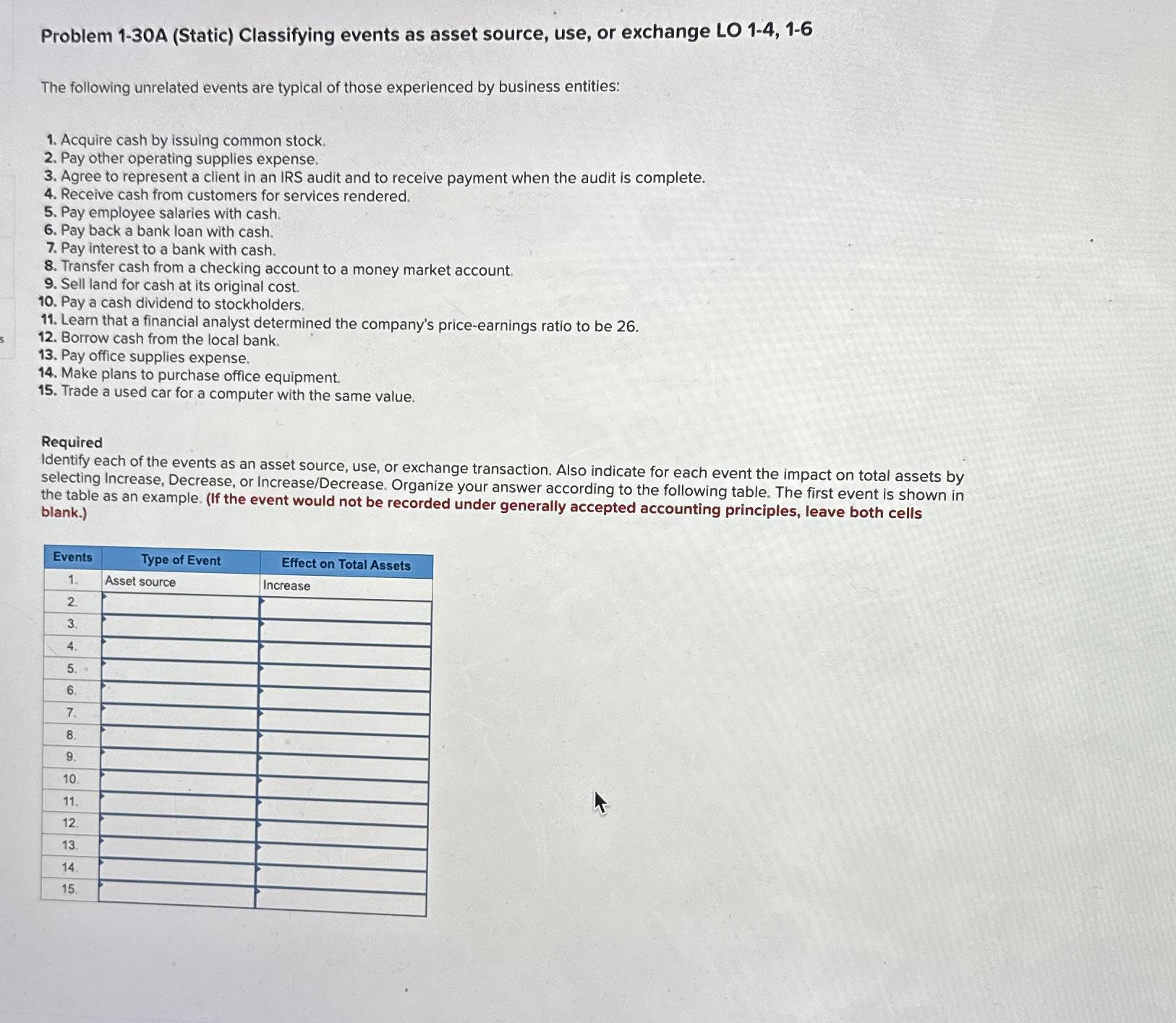

Problem 1-30A (Static) Classifying events as asset source, use, or exchange LO 1-4, 1-6\ The following unrelated events are typical of those experienced by business entities:\ Acquire cash by issuing common stock.\ Pay other operating supplies expense.\ Agree to represent a client in an IRS audit and to receive payment when the audit is complete.\ Receive cash from customers for services rendered.\ Pay employee salaries with cash.\ Pay back a bank loan with cash.\ Pay interest to a bank with cash.\ Transfer cash from a checking account to a money market account.\ Sell land for cash at its original cost.\ Pay a cash dividend to stockholders.\ Learn that a financial analyst determined the company's price-earnings ratio to be 26 .\ Borrow cash from the local bank.\ Pay office supplies expense.\ Make plans to purchase office equipment.\ Trade a used car for a computer with the same value.\ Required\ Identify each of the events as an asset source, use, or exchange transaction. Also indicate for each event the impact on total assets by selecting Increase, Decrease, or Increase/Decrease. Organize your answer according to the following table. The first event is shown in the table as an example. (If the event would not be recorded under generally accepted accounting principles, leave both cells blank.)\ \\\\table[[Events,Type of Event,Effect on Total Assets],[1.,Asset source,Increase],[2.,,],[3.,,],[4.,,],[5.,,],[6.,,],[7.,,],[8.,,],[9.,,],[10.,,],[11.,,],[12.,,],[13.,,],[14.,,],[15.,,]]

Problem 1-30A (Static) Classifying events as asset source, use, or exchange LO 1-4, 1-6 The following unrelated events are typical of those experienced by business entities: 1. Acquire cash by issuing common stock. 2. Pay other operating supplies expense. 3. Agree to represent a client in an IRS audit and to receive payment when the audit is complete. 4. Receive cash from customers for services rendered. 5. Pay employee salaries with cash. 6. Pay back a bank loan with cash. 7. Pay interest to a bank with cash. 8. Transfer cash from a checking account to a money market account. 9. Sell land for cash at its original cost. 10. Pay a cash dividend to stockholders. 11. Learn that a financial analyst determined the company's price-earnings ratio to be 26 . 12. Borrow cash from the local bank. 13. Pay office supplies expense. 14. Make plans to purchase office equipment. 15. Trade a used car for a computer with the same value. Required Identify each of the events as an asset source, use, or exchange transaction. Also indicate for each event the impact on total assets by selecting Increase, Decrease, or Increase/Decrease. Organize your answer according to the following table. The first event is shown in the table as an example. (If the event would not be recorded under generally accepted accounting principles, leave both cells blank.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts