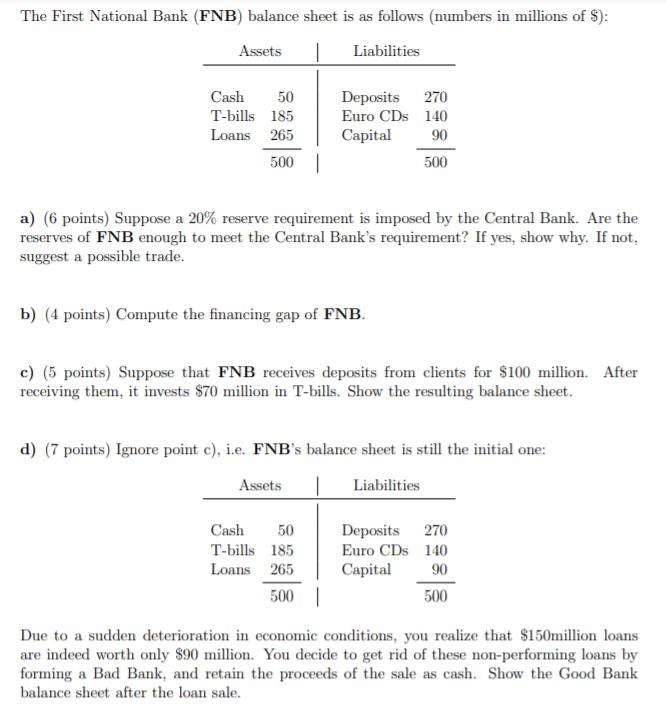

Question: The First National Bank (FNB) balance sheet is as follows (numbers in millions of $): Assets 1 Liabilities Cash 50 T-bills 185 Loans 265

The First National Bank (FNB) balance sheet is as follows (numbers in millions of $): Assets 1 Liabilities Cash 50 T-bills 185 Loans 265 500 1 a) (6 points) Suppose a 20% reserve requirement is imposed by the Central Bank. Are the reserves of FNB enough to meet the Central Bank's requirement? If yes, show why. If not, suggest a possible trade. Deposits 270 Euro CDs 140 Capital 90 500 b) (4 points) Compute the financing gap of FNB. c) (5 points) Suppose that FNB receives deposits from clients for $100 million. After receiving them, it invests $70 million in T-bills. Show the resulting balance sheet. d) (7 points) Ignore point c), i.e. FNB's balance sheet is still the initial one: 1 Liabilities Assets Cash 50 T-bills 185 Loans 265 500 Deposits Euro CDs Capital 270 140 90 500 Due to a sudden deterioration in economic conditions, you realize that $150million loans are indeed worth only $90 million. You decide to get rid of these non-performing loans by forming a Bad Bank, and retain the proceeds of the sale as cash. Show the Good Bank balance sheet after the loan sale.

Step by Step Solution

3.55 Rating (169 Votes )

There are 3 Steps involved in it

Solution The entropy change of an ideal g... View full answer

Get step-by-step solutions from verified subject matter experts