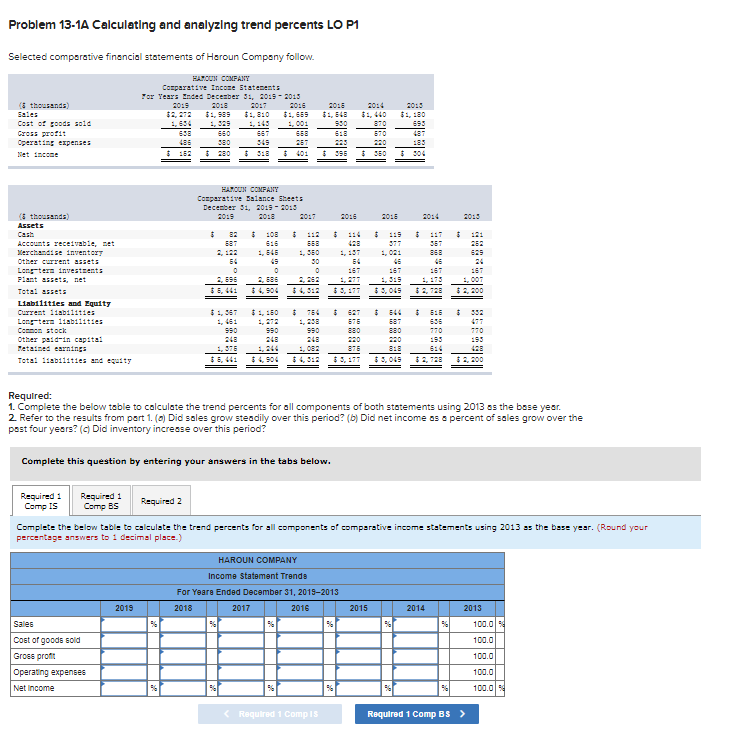

Question: Problem 13-14 Calculating and analyzing trend percents LO 21 Selected comparative financial statements of Heroun Company follow. FAMOUN COMPANY Corparative Incose Statesents For Years Ended

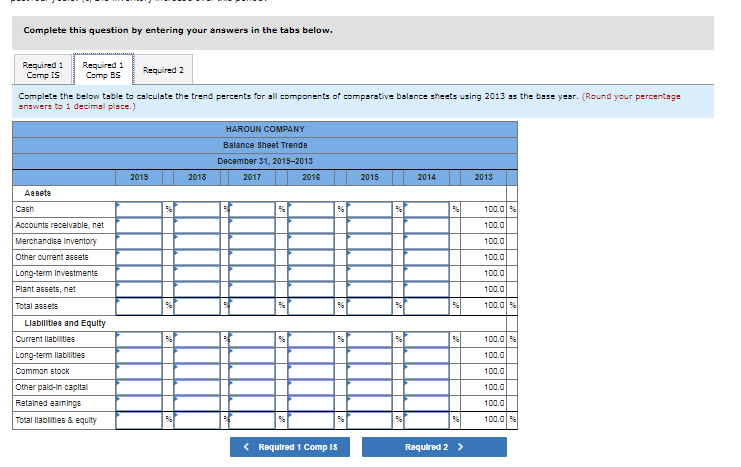

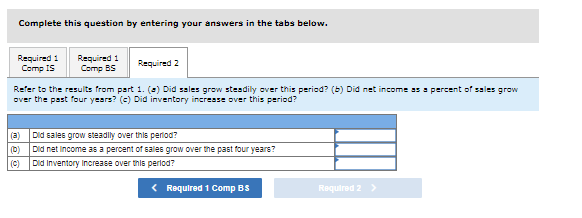

Problem 13-14 Calculating and analyzing trend percents LO 21 Selected comparative financial statements of Heroun Company follow. FAMOUN COMPANY Corparative Incose Statesents For Years Ended Deceber 3, 2009 - 2015 30:7 20:4 20:3 & thousands) Sales Cost of goods sold Cross Pro 11 Operating expenses 1.001 870 870 380 251 HAROUN COMPANY Cooperative Balance Sheets December 31, 2019 - 20:3 thousands) Assets $ $ $ $ 6 687 653 423 30 54 0 0 $2,200 Accounts receivable, et Merchandise inventory Other current assets Long-tere investcents Piant assets. net Tota: assets Liabilities and Equity Current 11abilities Lorters liabilities Cenon stock Other puid-in capital Netained earnings Total 1.abilities and easy $ $ $ 844 8 880 110 248 1,976 8:8 Required: 1. Complete the below table to calculate the trend percents for all components of both statements using 2013 ss the bese year. 2 Refer to the results from part 1. (o) Did sales grow steadily over this period? (6) Did net income as a percent of sales grow over the past four yesrs? (Did inventory increase over this period? Complete this question by entering your answers in the tabs below. Required 1 Comp IS Required 1 Comp BS Required 2 Complete the below table to calculate the trend percents for all components of comparative income statements using 2013 as the base year. (Round your percentage answers to 1 decimal place.) HAROUN COMPANY Income Statement Trends For Year Ended December 31, 2015-2013 2018 2017 2016 56 2019 2015 2014 2013 8 56 100.0 100.0 Sales Cost of goods sold Gross proft Operating expenses 100.0 100.0 100.0 Net Income 86 Required 1 Compis Required 1 Comp BS > Complete this question by entering your answers in the tabs below. Required: Comp IS Required 1 Comp BS Required 2 Complete the below table to calculate the trend percents for all components of comparative balance sheets using 2013 as the base year. (Round your percentage answers to 1 decimal place.) HAROUN COMPANY Balance Sheet Trends December 31, 2019-2013 2017 2016 2019 2018 2015 2014 2013 Assets Cash 56 56 100.0 % 100.0 100.0 100.0 100.0 Accounts receivable, net Merchandise inventory Other current assets Long-term Investments Plant assets, net Total assets Llabilities and Equity Current Ilabilities Long-term Ilabilities Common stock 100.0 100.0 % 56 96 100.0% 100.0 100.0 100.0 Other pald-in capital Retained earnings Total llablities & equity 100.0 $ 56 100.0 % Complete this question by entering your answers in the tabs below. Required: Comp IS Required 1 Comp BS Required 2 Refer to the results from part 1. (-) Did sales grow steadily over this period? (6) Did net income as a percent of sales grow over the past four years? (c) Did inventory increase over this period? (a) D) Did sales grow steadily over this period? Did net income as a percent of sales grow over the past four years? Did Inventory Increase over this period?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts