Question: Problem 13-1A Here are comparative statement data for Duke Company and Lord Company, two competitors. All balance sheet data are as of December 31, 2017,

Problem 13-1A

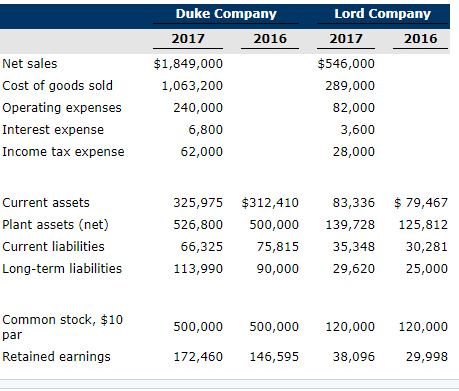

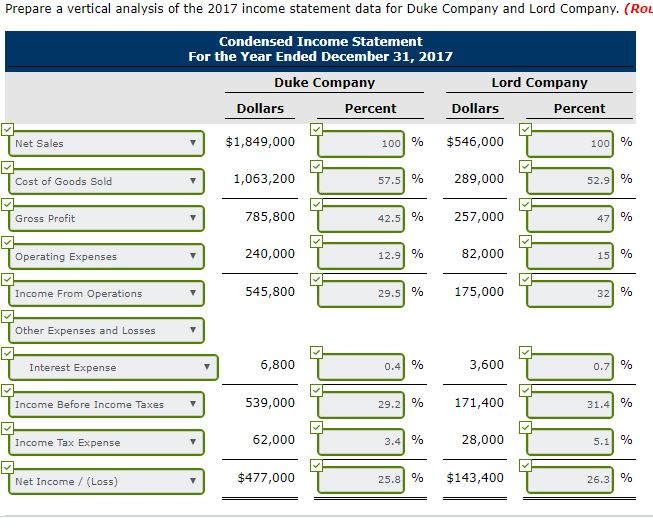

Here are comparative statement data for Duke Company and Lord Company, two competitors. All balance sheet data are as of December 31, 2017, and December 31, 2016.

Compute the 2017 return on assets and the return on common stockholders equity for both companies.

Duke Company Lord Company 2017 2016 2017 2016 Net sales Cost of goods sold Operating expenses Interest expense Income tax expense $1,849,000 1,063,200 240,000 6,800 62,000 $546,000 289,000 82,000 3,600 28,000 Current assets Plant assets (net) Current liabilities Long-term liabilities 325,975 $312,410 83,336 79,467 526,800 500,000 139,728 125,812 35,348 30,281 29,620 25,000 66,325 113,990 75,815 90,000 Common stock, $10 par Retained earnings 500,000 500,000 120,000 120,000 172,460 146,595 38,096 29,998

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts