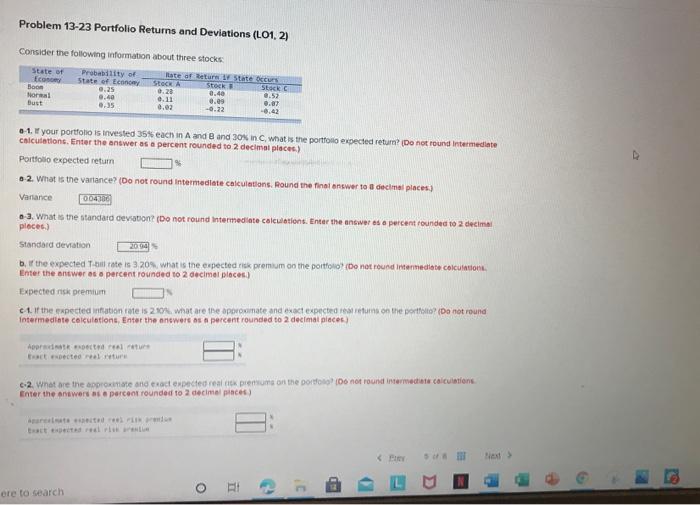

Question: Problem 13-23 Portfolio Returns and Deviations (L01, 2) Consider the following information about three stocks State of Probability of te af deturn State curs State

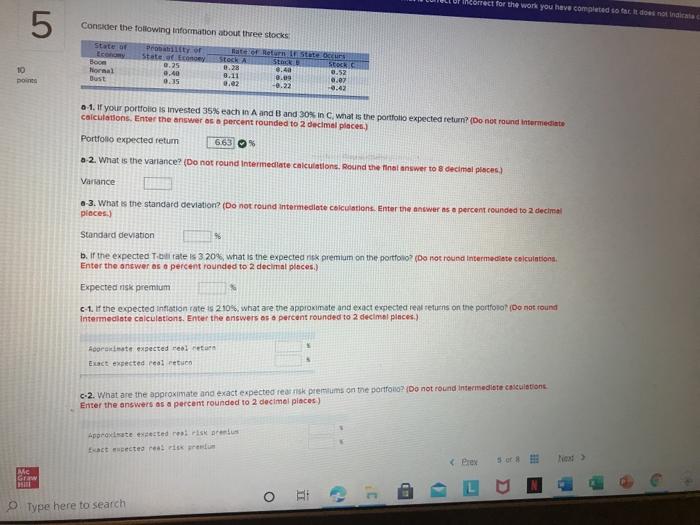

Problem 13-23 Portfolio Returns and Deviations (L01, 2) Consider the following information about three stocks State of Probability of te af deturn State curs State of Economy STOCK Boon 0.25 Stack 0.28 More 9.40 0.40 0.11 8.53 Bust 0.35 0.09 0.02 0.07 -0.42 1. your portfolio is invested 35% each in A and B and 30% in C, what is the portfolio expected return? (Do not found intermediate Chiculations. Enter the answer as a percent rounded to 2 decimal places) Portfolio expected return . 2. What is the vartance? (Do not round Intermediate calculations. Round the final answer to 3 decimal places) Variance 0043d - 3. What is the standard deviation (Do not round Intermediate calculations. Enter the answer as a percent rounded to 2 decima places) Standard deviation 2099 bil the expected Toll rate is 3 20% what is the expected risk premium on the portfoo (Do not round Intermediate calculation Enter the answer as a percent rounded to 2 decimal places) Expected risk premium chat the mette intation tate is 27 What are the approximate and exact expected to return on the portfolio? (Do not round Intermediate calculation, Enter the answers as a percent rounded to 2 decimal places) Artxoarele tract expecte al ture 6.2. What are the approximate and exact pede reali premom on the portano (Do not round Intermediate calculations Enter the answers as a percent rounded to 2 decimal places) SI ere to search O Morrect for the work you have completed so fac de 5 Consider the following information about three stocks State of stock 10 bo Boom hermal Bust State EDRY 0.25 0.40 0.35 0.28 8.11 0.02 Stock 0.48 0.00 -0.22 Stock 0.52 0.07 0.43 6.1. If your portfolio is invested 35% each in A and B and 30% in what is the portfolio expected return? (Do not round Intermediate calculations. Enter the answer as a percent rounded to 2 decimal places.) Portfolio expected return 6,63% a 2. What is the variance? (Do not round Intermediate calculations. Round the final answer to decimal places) Varance .-3. What is the standard deviation? (Do not found intermediate calculations. Enter the answer as a percent rounded to 2 decimal places) Standard deviation b. If the expected Tbilitate is 3 20% what is the expected na premium on the portfolio? (Do not round Intermediate calculations Enter the answer as a percent rounded to 2 decimal places.) Expected nsk premium -1. If the expected infiation rate is 210%, what are the approximate and exact expected real returns on the portfoto (Do not found Intermediate calculations. Enter the answers as a percent rounded to 2 decimal places.) Agrote expected reoler Exact expected real retu c-2. What are the approximate and exact expected rear risk premiums on the portoroz Do not round Intermediate calculetion Enter the answers as a percent rounded to 2 decimal places) Approxecte ested reiskus act meteorisk rens & Prov EME GA CH O BE Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts