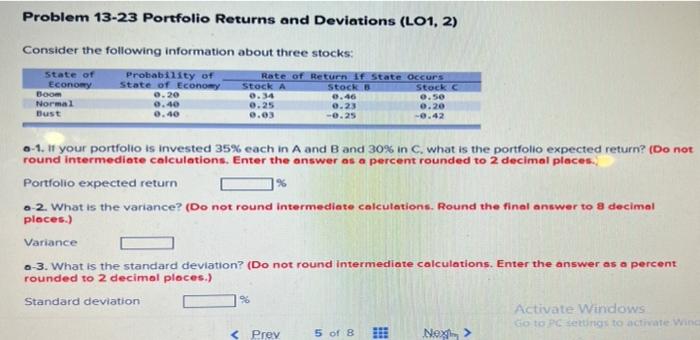

Question: Problem 13-23 Portfolio Returns and Deviations (LO1, 2) Consider the following information about three stocks: State of Economy Boom Normal Bust Probability of State of

Problem 13-23 Portfolio Returns and Deviations (LO1, 2) Consider the following information about three stocks: State of Economy Boom Normal Bust Probability of State of Economy 0.20 0.40 0.40 Rate of Return If State Occurs Stock A Stock Stock e 0.34 0.46 0.50 0.25 0.23 0.20 0.03 -0.25 % 0-1. 11 your portfolio is invested 35% each in A and B and 30% in C. what is the portfolio expected return? (Do not round Intermediate calculations. Enter the answer as a percent rounded to 2 decimal places. Portfolio expected return .-2. What is the variance? (Do not round intermediato calculations. Round the final answer to a decimal places.) Variance .-3. What is the standard deviation? (Do not round Intermediate calculations. Enter the answer as a percent rounded to 2 decimal places.) Standard deviation Activate Windows Go to Petting to activate wind

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts