Question: Problem 13-23 Portfolio Returns and Deviations (LO1, 2) Consider the following information about three stocks: State of Economy Boom Normal Bust Probability of State of

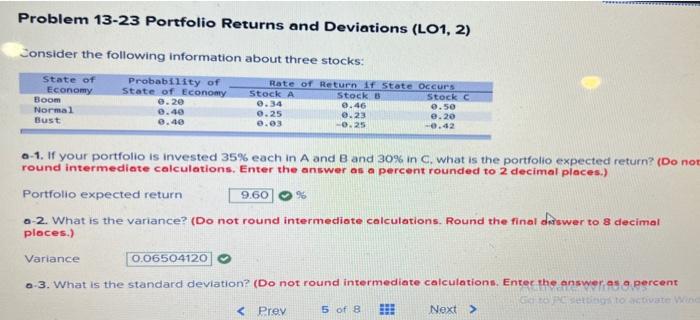

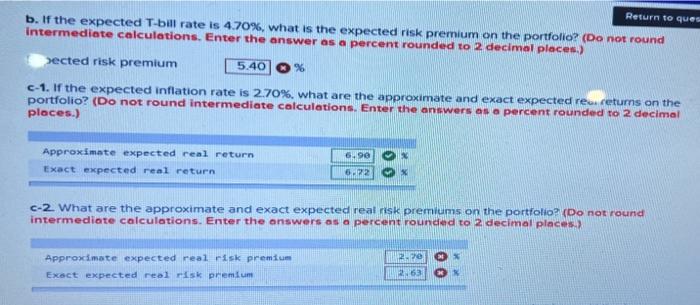

Problem 13-23 Portfolio Returns and Deviations (LO1, 2) Consider the following information about three stocks: State of Economy Boom Normal Bust Probability of State of Economy 0.20 0.40 .40 Rate of Return if State Occurs Stock A Stocks Stock 0.34 0.46 0.50 0.25 0.23 0.20 0.03 -0.25 -0.42 0-1. If your portfolio is invested 35% each in A and B and 30% in c. what is the portfolio expected return? (Do not round intermediate calculations. Enter the answer as a percent rounded to 2 decimal places.) Portfolio expected return 9.60% .-2. What is the variance? (Do not round intermediate calculations. Round the final diswer to 8 decimal places.) Variance 0.06504120 .-3. What is the standard deviation? (Do not round intermediate calculations. Enter the answer as a percent to ovate Wine Return to ques b. If the expected T-bill rate is 4.70%, what is the expected risk premium on the portfolio? (Do not round Intermediate calculations. Enter the answer as a percent rounded to 2 decimal places. >ected risk premium 5.40 % c-1. If the expected inflation rate is 2.70%, what are the approximate and exact expected reu. Ceturns on the portfolio? (Do not round intermediate calculations. Enter the answers as a percent rounded to 2 decimal places.) 6490 Approximate expected real return Exact expected real return 5.22 C-2. What are the approximate and exact expected real risk premiums on the portfolio? (Do not round intermediate calculations. Enter the answers as a percent rounded to 2 decimal places.) Approximate expected real risk premium Exact expected real risk premium 2.70 2.63 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts