Question: Problem 13-24 (Algo) Activity-based costing versus traditional overhead allocation methods LO 9 Woodland Industries manufactures and sells custom-made windows. Its job costing system was designed

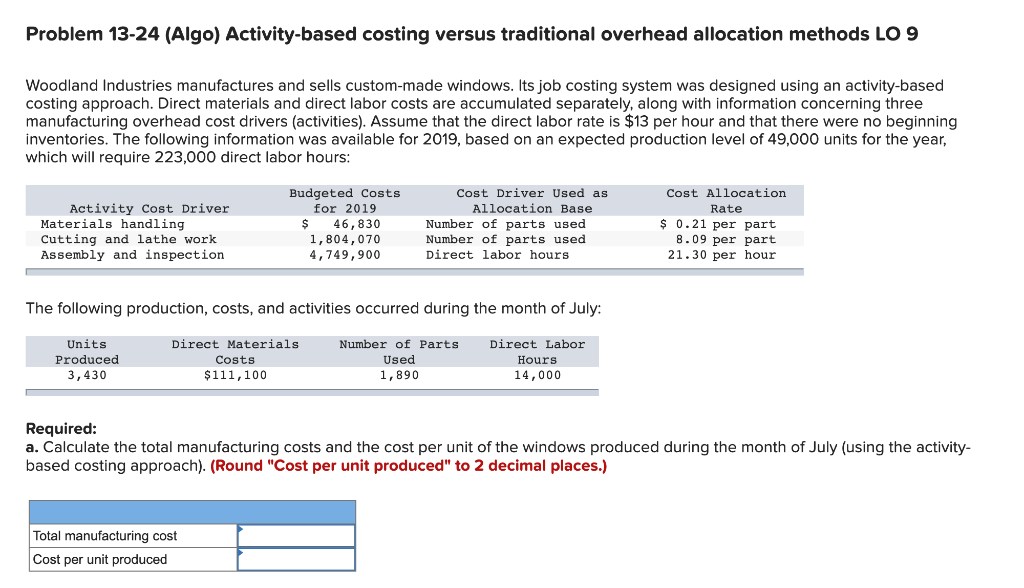

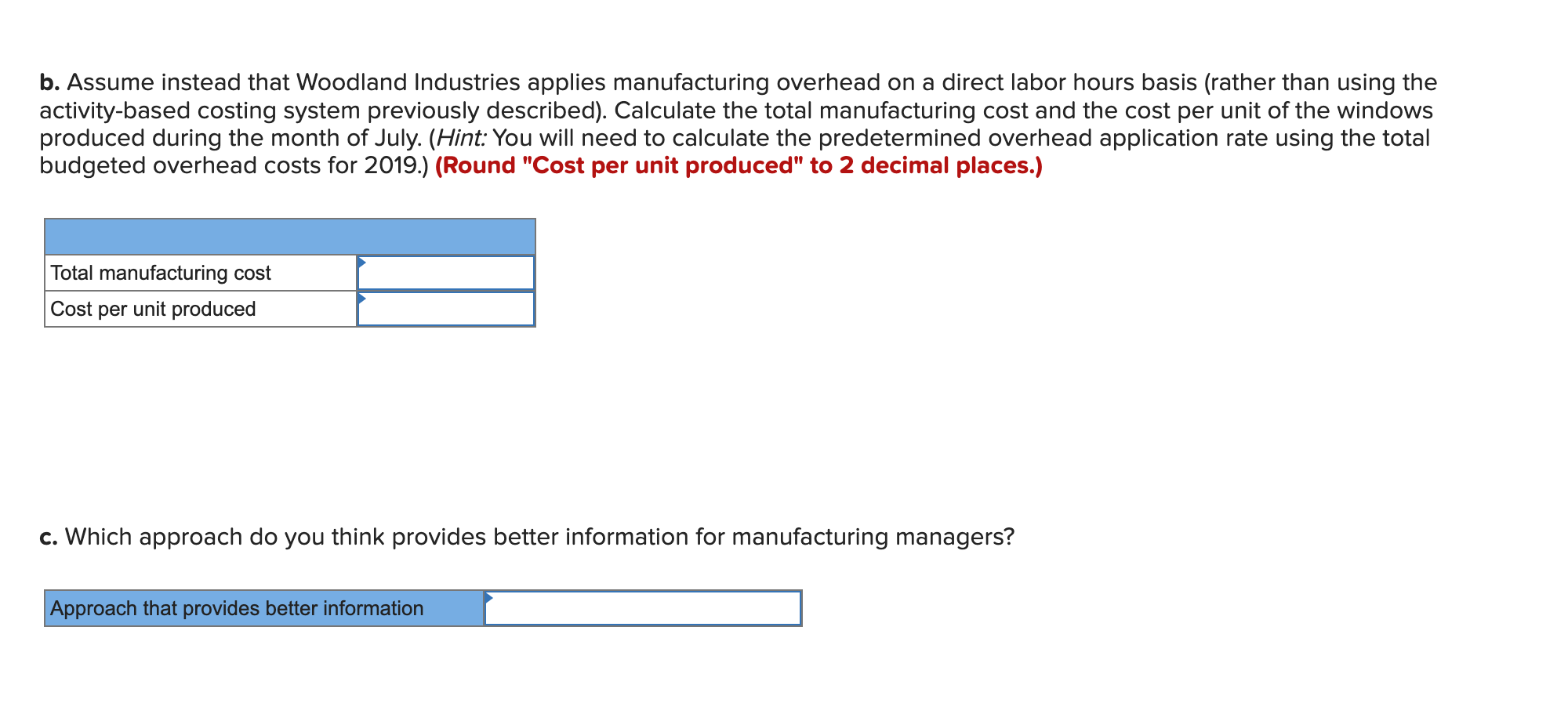

Problem 13-24 (Algo) Activity-based costing versus traditional overhead allocation methods LO 9 Woodland Industries manufactures and sells custom-made windows. Its job costing system was designed using an activity-based costing approach. Direct materials and direct labor costs are accumulated separately, along with information concerning three manufacturing overhead cost drivers (activities). Assume that the direct labor rate is $13 per hour and that there were no beginning inventories. The following information was available for 2019, based on an expected production level of 49,000 units for the year, which will require 223,000 direct labor hours: Activity Cost Driver Materials handling Cutting and lathe work Assembly and inspection Budgeted Costs for 2019 $ 46,830 1,804,070 4,749,900 Cost Driver Used as Allocation Base Number of parts used Number of parts used Direct labor hours Cost Allocation Rate $ 0.21 per part 8.09 per part 21.30 per hour The following production, costs, and activities occurred during the month of July: Units Produced 3, 430 Direct Materials Costs $111,100 Number of Parts Used 1,890 Direct Labor Hours 14,000 Required: a. Calculate the total manufacturing costs and the cost per unit of the windows produced during the month of July (using the activity- based costing approach). (Round "Cost per unit produced" to 2 decimal places.) Total manufacturing cost Cost per unit produced b. Assume instead that Woodland Industries applies manufacturing overhead on a direct labor hours basis (rather than using the activity-based costing system previously described). Calculate the total manufacturing cost and the cost per unit of the windows produced during the month of July. (Hint: You will need to calculate the predetermined overhead application rate using the total budgeted overhead costs for 2019.) (Round "Cost per unit produced" to 2 decimal places.) Total manufacturing cost Cost per unit produced c. Which approach do you think provides better information for manufacturing managers? Approach that provides better information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts