Question: Problem 1324 (Algo) Activity-based costing versus traditional overhead allocation methods LO 139 Woodland Industries manufactures and sells custom-made windows. Its job costing system was designed

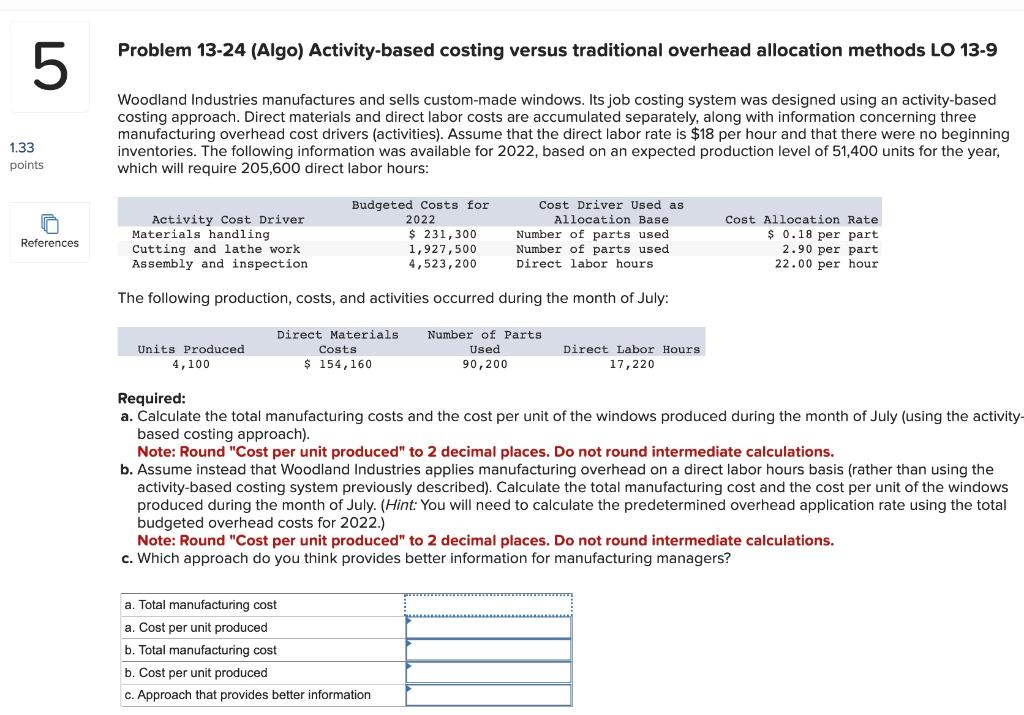

Problem 1324 (Algo) Activity-based costing versus traditional overhead allocation methods LO 139 Woodland Industries manufactures and sells custom-made windows. Its job costing system was designed using an activity-based costing approach. Direct materials and direct labor costs are accumulated separately, along with information concerning three manufacturing overhead cost drivers (activities). Assume that the direct labor rate is $18 per hour and that there were no beginning inventories. The following information was available for 2022 , based on an expected production level of 51,400 units for the year, which will require 205,600 direct labor hours: The following production, costs, and activities occurred during the month of July: Required: a. Calculate the total manufacturing costs and the cost per unit of the windows produced during the month of July (using the activity based costing approach). Note: Round "Cost per unit produced" to 2 decimal places. Do not round intermediate calculations. b. Assume instead that Woodland Industries applies manufacturing overhead on a direct labor hours basis (rather than using the activity-based costing system previously described). Calculate the total manufacturing cost and the cost per unit of the windows produced during the month of July. (Hint: You will need to calculate the predetermined overhead application rate using the total budgeted overhead costs for 2022 .) Note: Round "Cost per unit produced" to 2 decimal places. Do not round intermediate calculations. c. Which approach do you think provides better information for manufacturing managers? Problem 1324 (Algo) Activity-based costing versus traditional overhead allocation methods LO 139 Woodland Industries manufactures and sells custom-made windows. Its job costing system was designed using an activity-based costing approach. Direct materials and direct labor costs are accumulated separately, along with information concerning three manufacturing overhead cost drivers (activities). Assume that the direct labor rate is $18 per hour and that there were no beginning inventories. The following information was available for 2022 , based on an expected production level of 51,400 units for the year, which will require 205,600 direct labor hours: The following production, costs, and activities occurred during the month of July: Required: a. Calculate the total manufacturing costs and the cost per unit of the windows produced during the month of July (using the activity based costing approach). Note: Round "Cost per unit produced" to 2 decimal places. Do not round intermediate calculations. b. Assume instead that Woodland Industries applies manufacturing overhead on a direct labor hours basis (rather than using the activity-based costing system previously described). Calculate the total manufacturing cost and the cost per unit of the windows produced during the month of July. (Hint: You will need to calculate the predetermined overhead application rate using the total budgeted overhead costs for 2022 .) Note: Round "Cost per unit produced" to 2 decimal places. Do not round intermediate calculations. c. Which approach do you think provides better information for manufacturing managers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts