Question: Problem 13-24 Blake Weaver, Crane Enterprises' controller, is preparing the financial statements for 2016. He has completed the comparative balance sheets and income statement, which

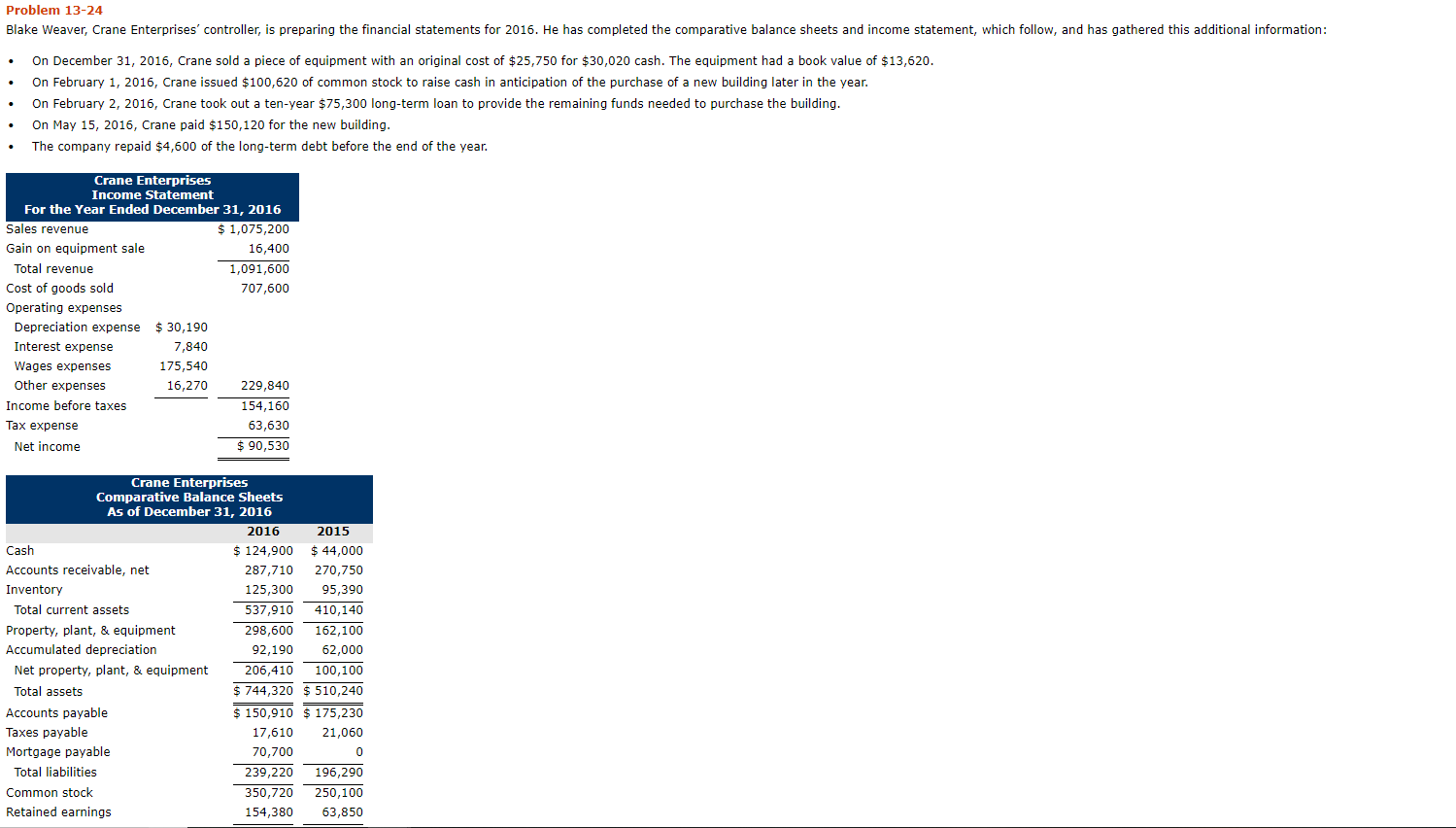

Problem 13-24 Blake Weaver, Crane Enterprises' controller, is preparing the financial statements for 2016. He has completed the comparative balance sheets and income statement, which follow, and has gathered this additional information: On December 31, 2016, Crane sold a piece of equipment with an original cost of $25,750 for $30,020 cash. The equipment had a book value of $13,620. On February 1, 2016, Crane issued $100,620 of common stock to raise cash in anticipation of the purchase of a new building later in the year. On February 2, 2016, Crane took out a ten-year $75,300 long-term loan to provide the remaining funds needed to purchase the building. On May 15, 2016, Crane paid $150,120 for the new building. The company repaid $4,600 of the long-term debt before the end of the year. Crane Enterprises Income Statement For the Year Ended December 31, 2016 Sales revenue $ 1,075,200 Gain on equipment sale 16,400 Total revenue 1,091,600 Cost of goods sold 707,600 Operating expenses Depreciation expense $ 30,190 Interest expense 7,840 Wages expenses 175,540 Other expenses 16,270 229,840 Income before taxes 154,160 Tax expense 63,630 Net income $ 90,530 Crane Enterprises Comparative Balance Sheets As of December 31, 2016 2016 2015 Cash $ 124,900 $ 44,000 Accounts receivable, net 287,710 270,750 Inventory 125,300 95,390 Total current assets 537,910 410,140 Property, plant, & equipment 298,600 162,100 Accumulated depreciation 92,190 62,000 Net property, plant, & equipment 206,410 100,100 Total assets $ 744,320 $ 510,240 Accounts payable $ 150,910 $ 175,230 Taxes payable 17,610 21,060 Mortgage payable 70,700 Total liabilities 239,220 196,290 Common stock 350,720 250,100 Retained earnings 154,380 63,850 Total stockholders' equity Total liabilities & stockholders' equity 505,100 313,950 $ 744,320 $ 510,240 Using the indirect method, prepare Crane Enterprises' statement of cash flows for 2016. (Show amounts that decrease cash flow with either a - sign, e.g. -15,000 or in parentheses, e.g. (15,000).) Crane Enterprises Statement of Cash Flows For the Year Ended December 31, 2016 Net cash Net cash by activities activities Net cash by activities artis Net cash by activitie activities Net cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts