Question: Problem 13-24 Blake Weaver, Wildhorse Enterprises' controller, is preparing the financial statements for 2016. He has completed the comparative balance sheets and income statement, which

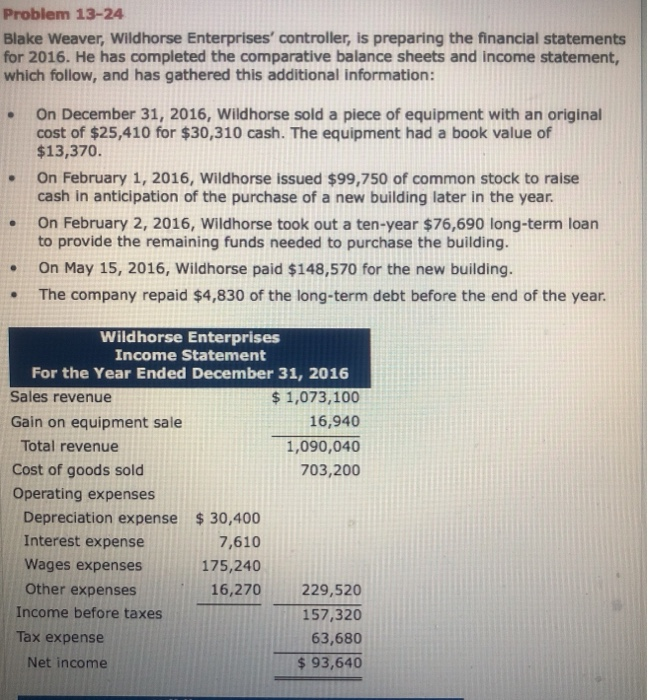

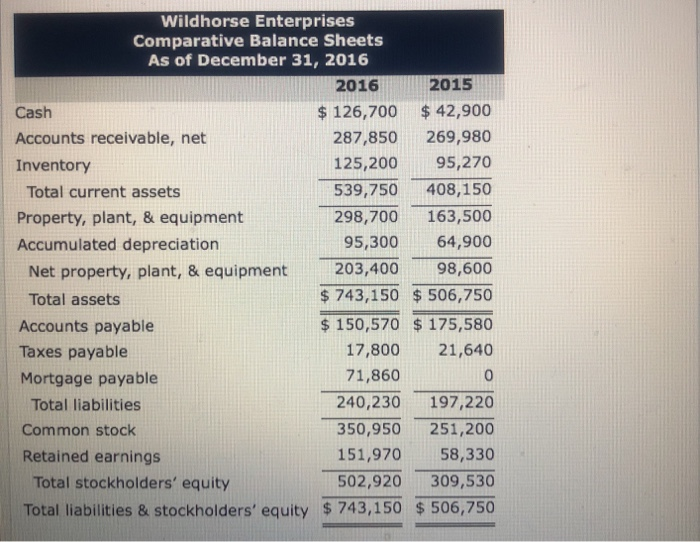

Problem 13-24 Blake Weaver, Wildhorse Enterprises' controller, is preparing the financial statements for 2016. He has completed the comparative balance sheets and income statement, which follow, and has gathered this additional information: On December 31, 2016, Wildhorse sold a piece of equipment with an original cost of $25,410 for $30,310 cash. The equipment had a book value of $13,370. cash in anticipation of the purchase of a new building later in the year to provide the remaining funds needed to purchase the building. On February 1, 2016, Wildhorse issued $99,750 of common stock to raise On February 2, 2016, Wildhorse took out a ten-year $76,690 long-term loan .On May 15, 2016, Wildhorse paid $148,570 for the new building. The company repaid $4,830 of the long-term debt before the end of the year. Wildhorse Enterprises Income Statement For the Year Ended December 31, 2016 Sales revenue Gain on equipment sale s 1,073,100 16,940 1,090,040 703,200 Total revenue Cost of goods sold Operating expenses Depreciation expense Interest expense Wages expenses Other expenses $ 30,400 7,610 175,240 16,270 229,520 157,320 63,680 $93,640 Income before taxes Tax expense Net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts