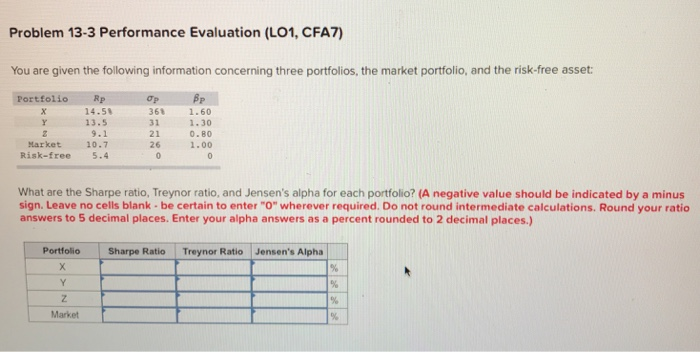

Question: Problem 13-3 Performance Evaluation (LO1, CFA7) You are given the following information concerning three portfolios, the market portfolio, and the risk-free asset Bp Portfol1o Rp

Problem 13-3 Performance Evaluation (LO1, CFA7) You are given the following information concerning three portfolios, the market portfolio, and the risk-free asset Bp Portfol1o Rp 4.5 13.5 9.1 10.7 Risk-free 5.4 361 1.60 31 1.30 21 26 1.00 0.80 Market What are the Sharpe ratio, Treynor ratio, and Jensen's alpha for each portfolio? (A negative value should be indicated by a minus sign. Leave no cells blank be certain to enter "O" wherever required. Do not round intermediate calculations. Round your ratio answers to 5 decimal places. Enter your alpha answers as a percent rounded to 2 decimal places.) Portfolio Sharpe Ratio Treynor Ratio Jensen's Alpha Market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts