Question: Problem 13-4 (Part Level Submission) Below is a payroll sheet for Blossom Import Company for the month of September 2017. The company is allowed a

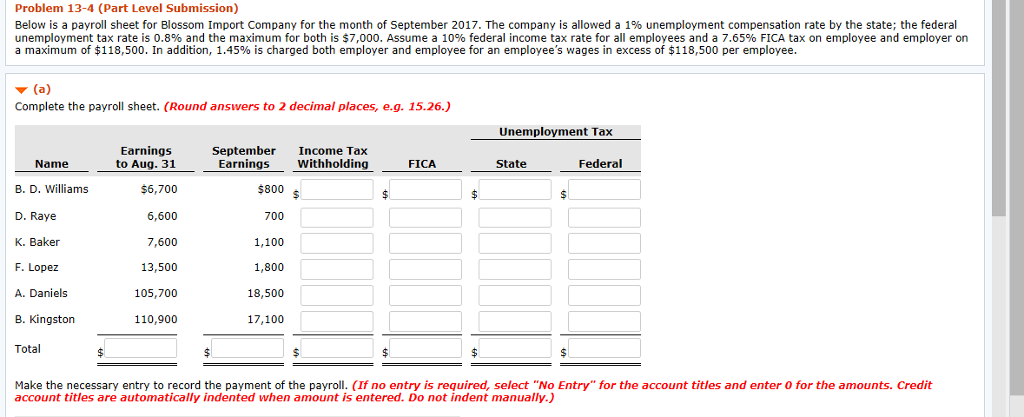

Problem 13-4 (Part Level Submission) Below is a payroll sheet for Blossom Import Company for the month of September 2017. The company is allowed a 1% unemployment compensation rate by the state; the federal unemployment tax rate is 0.8% and the maximum for both is $7,000. Assume a 10% federal income tax rate for all employees and a 7.65% FICA tax on employee and employer on a maximum of $118,500. In addition, 1.45% is charged both employer and employee for an employee's wages in excess of $118,500 per employee ? (a) Complete the payroll sheet. (Round answers to 2 decimal places, e.g. 15.26.) Unemployment Tax Earnings September Income Tax Withholding Name Earnings FICA State Federa B. D. Williams D. Raye K. Baker F. Lopez A. Daniels B. Kingston Total to Aug. 31 $6,700 6,600 7,600 13,500 105,700 110,900 $800 700 1,100 1,800 18,500 17,100 Make the necessary entry to record the payment of the payroll. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts