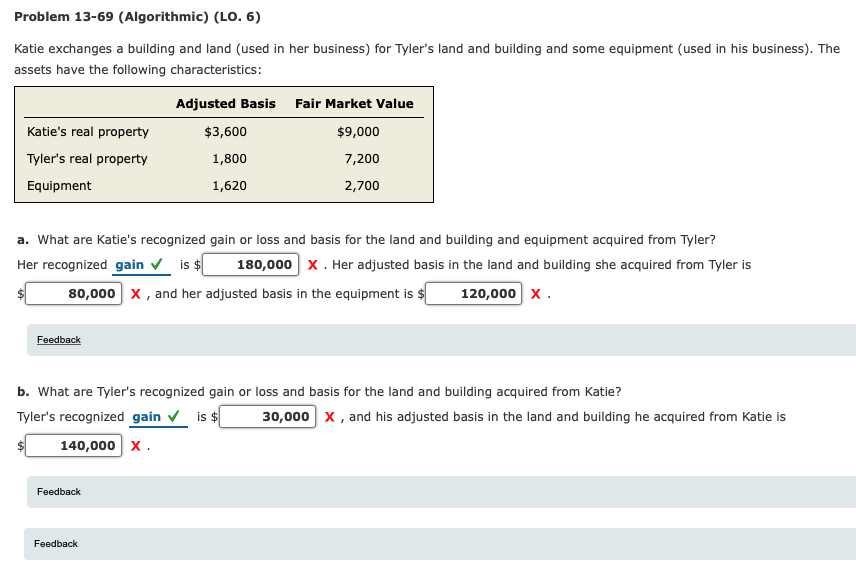

Question: Problem 13-69 (Algorithmic) (LO. 6) Katie exchanges a building and land (used in her business) for Tyler's land and building and some equipment (used in

Problem 13-69 (Algorithmic) (LO. 6) Katie exchanges a building and land (used in her business) for Tyler's land and building and some equipment (used in his business). The assets have the following characteristics: Adjusted Basis Fair Market Value $3,600 $9,000 Katie's real property Tyler's real property Equipment 1,800 7,200 1,620 2,700 a. What are Katie's recognized gain or loss and basis for the land and building and equipment acquired from Tyler? Her recognized gain is $ 180,000 x. Her adjusted basis in the land and building she acquired from Tyler is 80,000 X, and her adjusted basis in the equipment is $ 120,000 x Feedback b. What are Tyler's recognized gain or loss and basis for the land and building acquired from Katie? Tyler's recognized gain is $ 30,000 X, and his adjusted basis in the land and building he acquired from Katie is 140,000 x Feedback Feedback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts