Question: Problem 1.4 Consider a risky (defaultable) company, with a constant haz- ard rate A 5% (per year) 1. What is the probability pa(1Y) that a

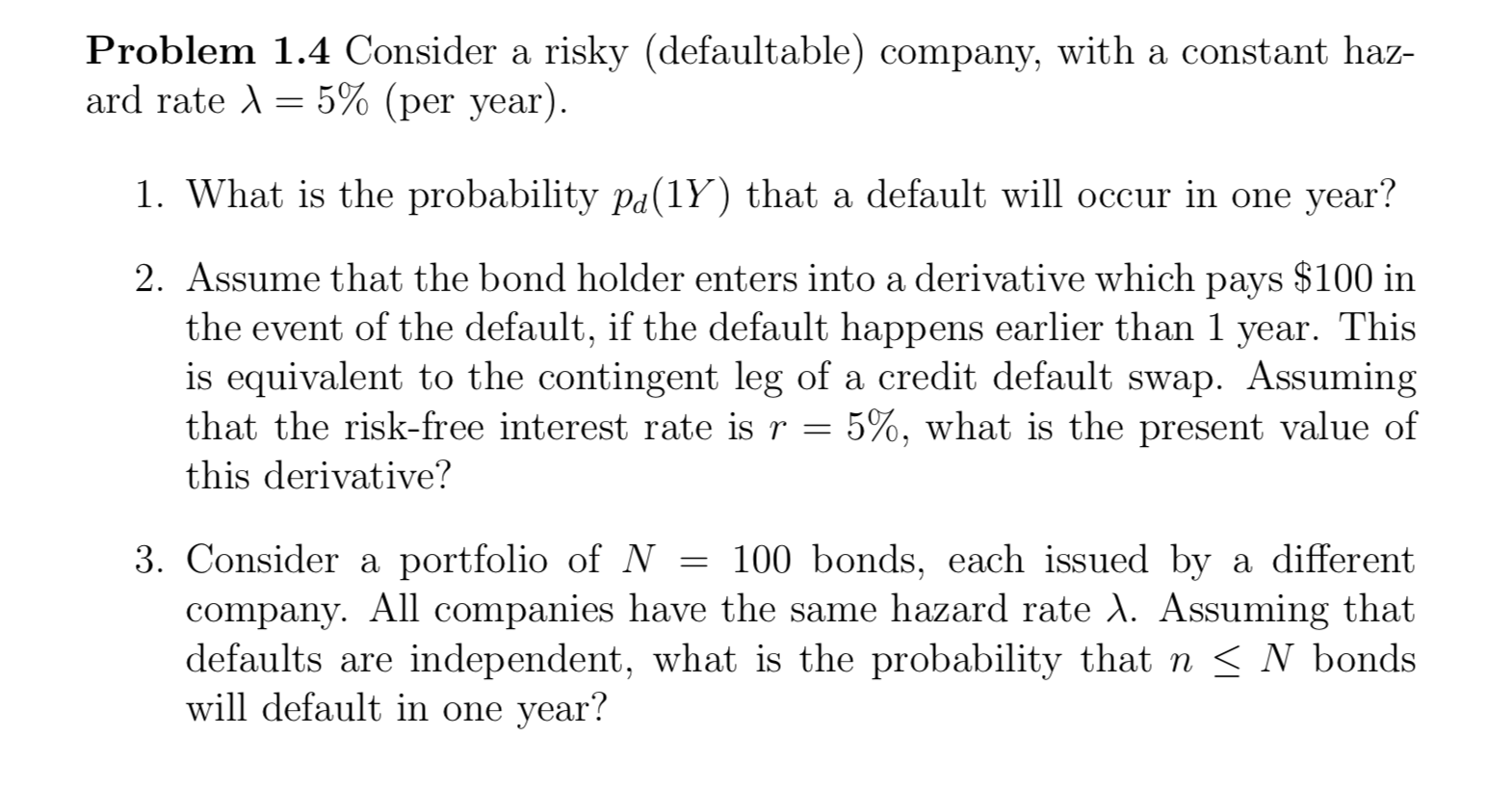

Problem 1.4 Consider a risky (defaultable) company, with a constant haz- ard rate A 5% (per year) 1. What is the probability pa(1Y) that a default will occur in one year? 2. Assume that the bond holder enters into a derivative which pays $100 in the event of the default, if the default happens earlier than 1 year. This is equivalent to the contingent leg of a credit default swap. Assuming that the risk-free interest rate is r = 5%, what is the present value of this derivative? 3. Consider a a different portfolio of N 100 bonds, each issued by company. All companies have the same hazard rate X. Assuming that defaults are independent, what is the probability that n year? N bonds will default in one Problem 1.4 Consider a risky (defaultable) company, with a constant haz- ard rate A 5% (per year) 1. What is the probability pa(1Y) that a default will occur in one year? 2. Assume that the bond holder enters into a derivative which pays $100 in the event of the default, if the default happens earlier than 1 year. This is equivalent to the contingent leg of a credit default swap. Assuming that the risk-free interest rate is r = 5%, what is the present value of this derivative? 3. Consider a a different portfolio of N 100 bonds, each issued by company. All companies have the same hazard rate X. Assuming that defaults are independent, what is the probability that n year? N bonds will default in one

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts