Question: Problem 1.4. You are given following information regarding 3-step binomial tree: 1. Each step is 3-month 2. The current stock price S(0) = 60 3.

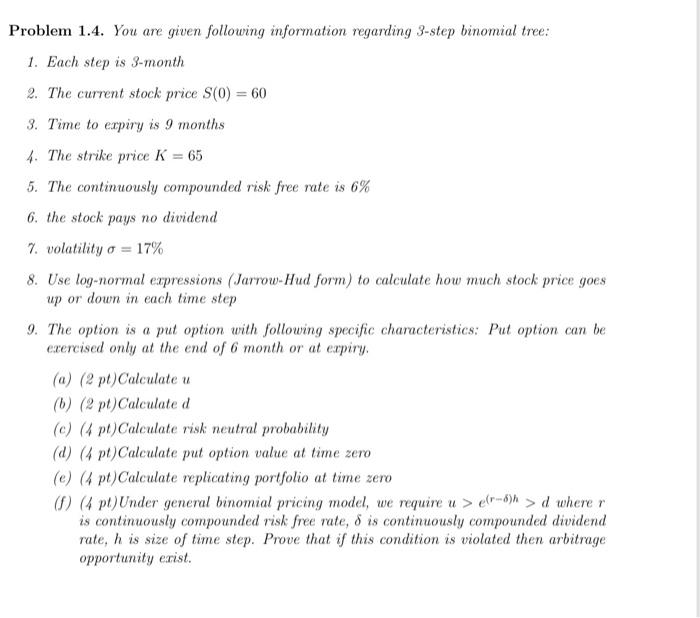

Problem 1.4. You are given following information regarding 3-step binomial tree: 1. Each step is 3-month 2. The current stock price S(0) = 60 3. Time to expiry is 9 months 4. The strike price K = 65 5. The continuously compounded risk free rate is 6% 6. the stock pays no dividend 7. volatility o = 17% 8. Use log-normal expressions (Jarrow-Hud form) to calculate how much stock price goes up or down in each time step 9. The option is a put option with following specific characteristics: Put option can be exercised only at the end of 6 month or at expiry. (a) (2 pt)Calculate u (6) (2 pt) Calculated (c) (4 pt)Calculate risk neutral probability (a) (4 pt)Calculate put option value at time zero (e) (4 pt)Calculate replicating portfolio at time zero () (4 pt) Under general binomial pricing model, we require u > e) > d wherer is continuously compounded risk free rate, 8 is continuously compounded dividend. rate, h is size of time step. Prove that if this condition is violated then arbitrage opportunity exist

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts