Question: Problem 14-02A a-c (Part Level Submission) The post closing trial balance of Oriole Corporation at December 31, 2020, contains the following stockholders' equity accounts. Preferred

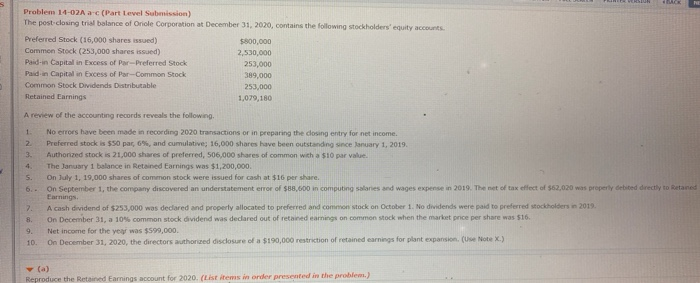

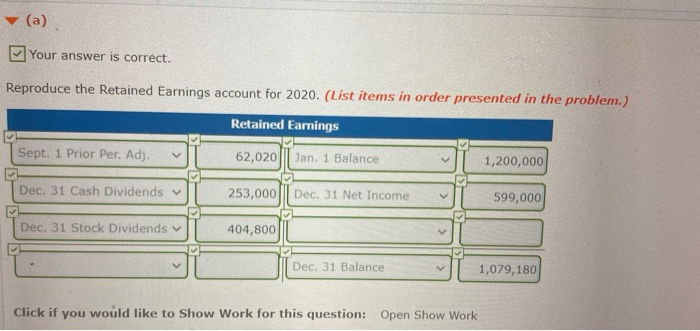

Problem 14-02A a-c (Part Level Submission) The post closing trial balance of Oriole Corporation at December 31, 2020, contains the following stockholders' equity accounts. Preferred Stock (16,000 shares issued) $800,000 Common Stock (253,000 shares issued) 2.530,000 Paid-in Capital in Excess of Par-Preferred Stock 253,000 Paid in Capital in Excess of Par Common Stock 389,000 Common Stock Dividends Distributable 253,000 Retained Earnings 1,079,180 A review of the accounting records reveals the following 1 No errors have been made in recording 2020 transactions or in preparing the dosing entry for net income 2 Preferred stock is $50 par, 6%, and cumulative; 16,000 shares have been outstanding since January 1, 2019 3. Authorized stockis 21,000 shares of preferred, 506,000 shares of common with a $10 par value The January 1 balance in Retained Earnings was $1,200,000 5. On July 1, 19,000 shares of common stock were issued for cash at $16 per share. 6. On September 1, the company discovered an understatement error of $88,600 in computing salaries and wages expense in 2019. The net of tax effect of $52,020 was property debited directly to Retained Earnings A cash dividend of $25,000 was declared and properly allocated to preferred and common stock on October 1. No dividends were paid to preferred stockholders in 2019. On December 31, a 10% common stock dividend was declared out of retained earnings on common stock when the market price per share was $16. income for the yey was $599,000 10. On December 31, 2020, the directors authorized disclosure of a $190,000 restriction of retained earnings for plant expansion (Use Note X.) Net (a) Reproduce the Retained Earnings account for 2020. (tist items in order presented in the problem.) (a) Your answer is correct. Reproduce the Retained Earnings account for 2020. (List items in order presented in the problem.) Retained Earnings Sept. 1 Prior Per. Adj. 62,020 Jan. 1 Balance 1,200,000 Dec. 31 Cash Dividends 253,000 Dec. 31 Net Income 599,000 Dec. 31 Stock Dividends 404,800 Dec. 31 Balance 1,079,180 Click if you would like to Show Work for this question: Open Show Work ORIOLE CORPORATION. Partial Balance Sheet $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts