Question: Problem 14-10 Your answer is partially correct. Try again. Presented below are four independent situations. (a) On March 1, 2018, Riverbed Co. issued at 104

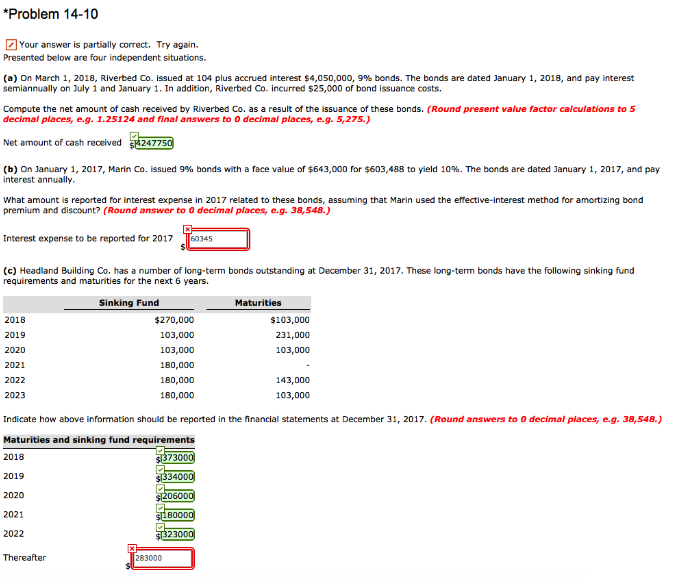

Problem 14-10 Your answer is partially correct. Try again. Presented below are four independent situations. (a) On March 1, 2018, Riverbed Co. issued at 104 plus accrued interest $4,050,000, 9% bonds. The bonds are dated January 1, 2018, and pay interest semiannually on July 1 and January 1. In addition, Riverbed Co. incurred $25,000 of bond issuance costs. Compute the net amount of cash received by Riverbed Co. as a result of the issuance of these bonds. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to 0 decimal places, e.g. S,275.) Net amount of cash received 42477 (b) On January 1, 2017, Marin Co. issued 996 bonds with a face value of $643,000 for $603,488 to yield 10%. The bonds are dated January 1, 2017, and pay interest annually What amount is reported for interest expense in 2017 related to these bonds, assuming that Marin used the effective-interest method for amortizing bond premium and discount? (Round answer to 0 decimal places, e.g. 38,548.) Interest expense to be reported for 2017 60345 (c) Headland Building Co. has a number of long-term bonds outstanding at December 31, 2017. These long-term bonds have the following sinking fund requirements and maturities for the next 6 years. Sinking Fund Maturities 2018 2019 2020 2021 2022 2023 $270,000 103,000 103,000 180,000 180,000 180,000 $103,000 231,000 103,000 143,000 103,000 Indicate how above information should be reported in the financial statements at December 31, 2017. (Round answers to O decimal places, e.g. 38,548.) Maturities and sinking fund requirements 2018 2019 2020 2021 2022 Thereafter 7300 3400 0600 8000 2300 283000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts