Question: Your answer is partially correct. Try again. Presented below are four independent situations. | (a) on March 1, 2018, Grouper Co. issued at 103 plus

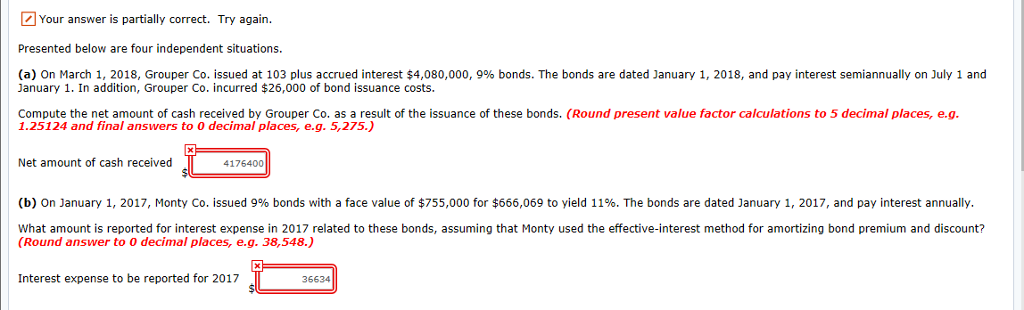

Your answer is partially correct. Try again. Presented below are four independent situations. | (a) on March 1, 2018, Grouper Co. issued at 103 plus accrued interest $4,080,000, 996 bonds. The bonds are dated January 1, 2018, and pay interest semiannually on July 1 and January 1. In addition, Grouper Co. incurred $26,000 of bond issuance costs. Compute the net amount of cash received by Grouper Co. as a result of the issuance of these bonds. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to O decimal places, e.g. 5,275.) Net amount of cash received (b) On January 1, 2017, Monty Co. issued 9% bonds with a face value of $755,000 for $666,069 to yield 11%. The bonds are dated January 1, 2017, and pay interest annually. What amount is reported for interest expense in 2017 related to these bonds, assuming that Monty used the effective-interest method for amortizing bond premium and discount? 4176400 (Round answer to 0 decimal places, e.g. 38,548.) Interest expense to be reported for 2017 36634

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts