Question: Problem 14-19 Calculating Flotation Costs (L04) Cully Company needs to raise $50 million to start a new project and will raise the money by selling

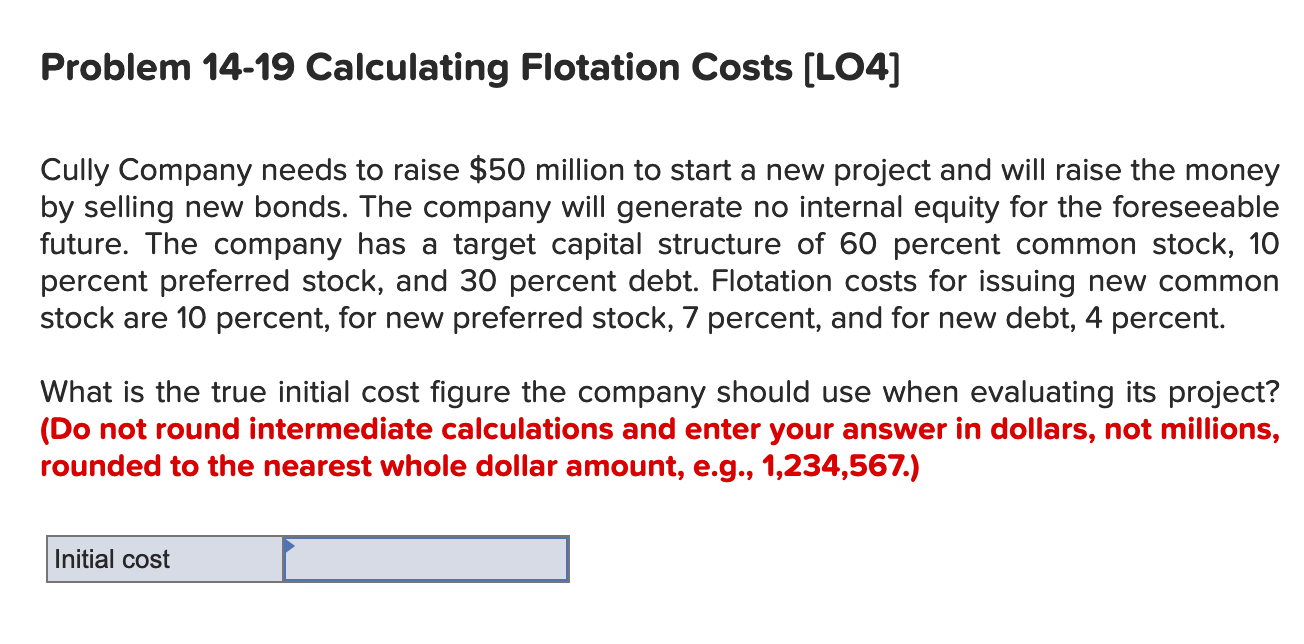

Problem 14-19 Calculating Flotation Costs (L04) Cully Company needs to raise $50 million to start a new project and will raise the money by selling new bonds. The company will generate no internal equity for the foreseeable future. The company has a target capital structure of 60 percent common stock, 10 percent preferred stock, and 30 percent debt. Flotation costs for issuing new common stock are 10 percent, for new preferred stock, 7 percent, and for new debt, 4 percent. What is the true initial cost figure the company should use when evaluating its project? (Do not round intermediate calculations and enter your answer in dollars, not millions, rounded to the nearest whole dollar amount, e.g., 1,234,567.) Initial cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts