Question: Problem 14-3 Straight-line and effective interest compared [LO14-2] On January 1, 2016, Bradley Recreational Products issued $100,000, 9%, four-year bonds. Interest is paid semiannually on

![Problem 14-3 Straight-line and effective interest compared [LO14-2] On January 1,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e91dc695aab_54166e91dc5f4012.jpg)

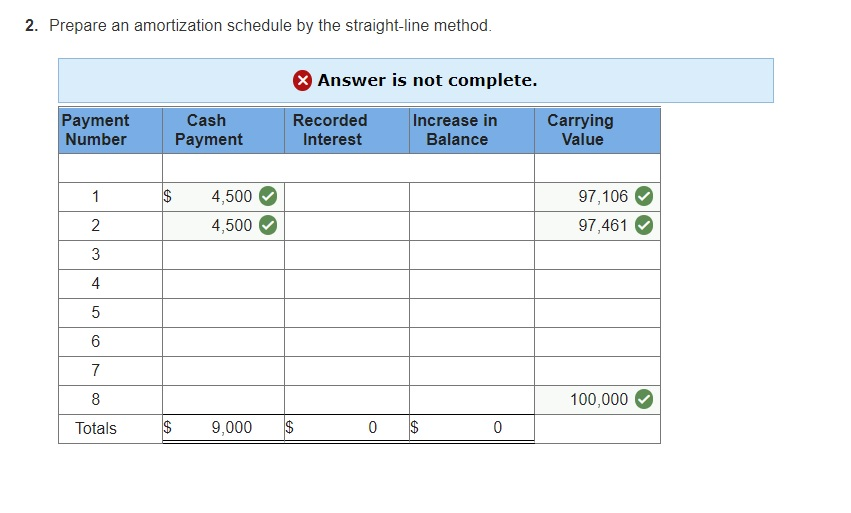

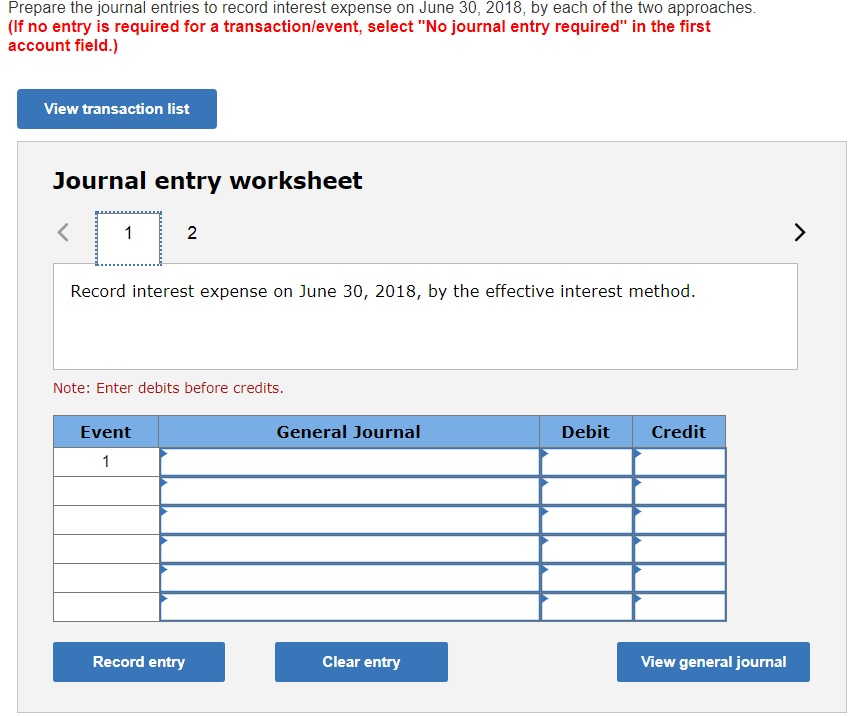

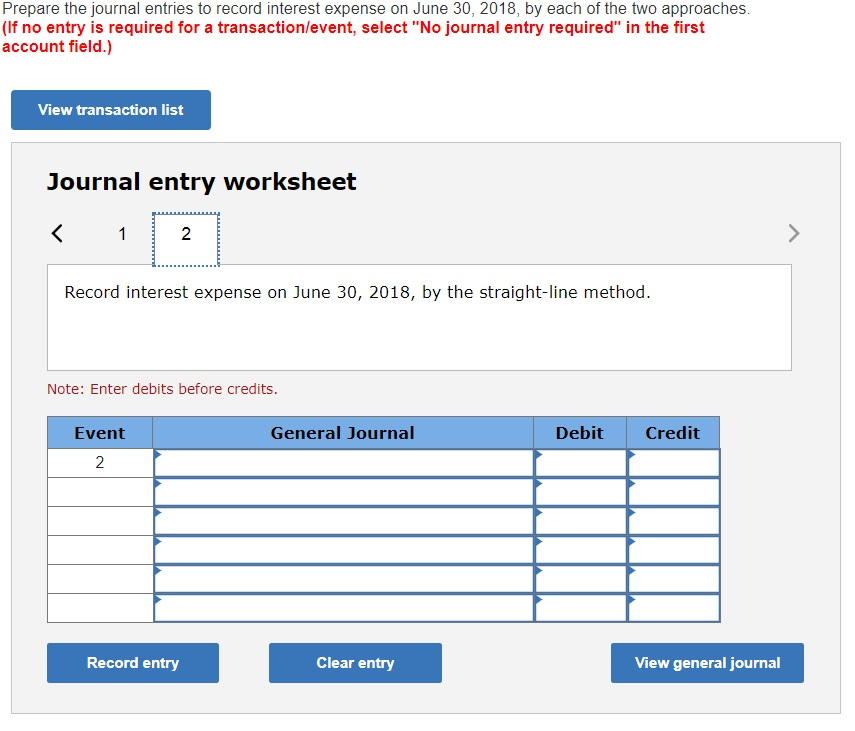

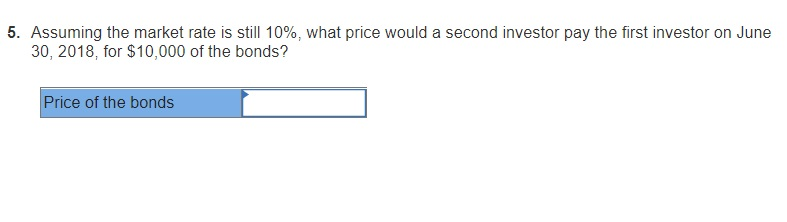

Problem 14-3 Straight-line and effective interest compared [LO14-2] On January 1, 2016, Bradley Recreational Products issued $100,000, 9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $96,768 to yield an annual return of 10%. (FV of $1, PV of $1, F A of $1, PVA of $1. FVAD of $1 and PVAD of $1 ) (Use appropriate factor(s) from the tables provided.) Required 1. Prepare an amortization schedule that determines interest at the effective interest rate Answer is complete and correct. Carrying Value Increase in Payment Number Cash Payment Effective Interest Balance 4,500 4,500 4,500 4,500 4,500 4,500 4,500 4,500 36,000 4,838 4,855 4,873 4,892 4,911 4,932 4,953 4,978 39,232 338 355 373 392 411 432 453 478 3,232 96,768 97,106 97,461 97,834 98,226 98,637 99,069 99,522 100,000 6 Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts