Question: Problem 144 ne Co, has a machine that cost $504,000 on March 20, 2014. This old machine had an estimated life of ten years and

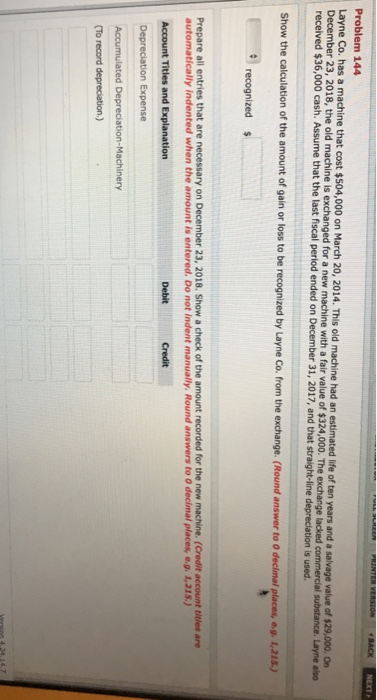

Problem 144 ne Co, has a machine that cost $504,000 on March 20, 2014. This old machine had an estimated life of ten years and a salvage value of $29,000. On received s36,000 cash. Assume that the last fiscal period ended on December 31, 2017, nd that srairstance, Layne abe Show the calculation of the amount of gain or loss to be recognized by Layne Co. from the exchange. (Round answer to O decimal places, eg. 1,215) is exchanged for a new machine with a fair value of $324,000. The exchange lacked recognized Prepare all entries that are necessary on December 23, 2018. Show a check of the amount recorded for the new machine. (Credit account titles are automatically indented when the amount is entered. Do not Indent manually, Round answers to 0 decimal places,e.g. 1,215.) Credit Account Titles and Explanation Accumulated Depreciation-Machinery (To record depreciation.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts