Question: Problem 14-42 (Algorithmic) (LO. 1, 2, 3) Roberto has received various gifts over the years and has decided to dispose of the following assets he

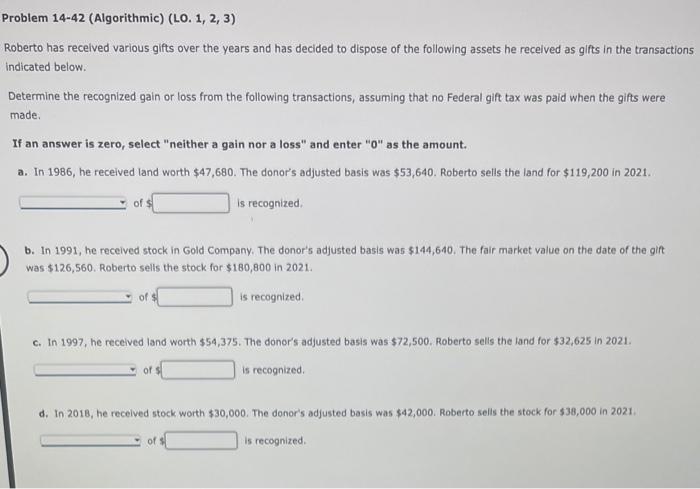

Problem 14-42 (Algorithmic) (LO. 1, 2, 3) Roberto has received various gifts over the years and has decided to dispose of the following assets he recelved as gifts in the transactions indicated below. Determine the recognized gain or loss from the following transactions, assuming that no Federal gift tax was paid when the gifts were made If an answer is zero, select "neither a gain nor a loss" and enter "0" as the amount a. In 1986, he received land worth $47,680. The donor's adjusted basis was $53,640. Roberto sells the land for $119,200 in 2021. of is recognized b. In 1991, he received stock in Gold Company. The donor's adjusted basis was $144,640. The fair market value on the date of the gift was $126,560. Roberto sells the stock for $180,800 in 2021. of is recognized c. In 1997, he received and worth $54,375. The donor's adjusted basis was $72,500. Roberto sells the land for $32,625 in 2021 is recognized or d. In 2018, he received stock worth $30,000. The donor's adjusted basis was $42,000. Roberto sells the stock for $38,000 in 2021 of is recognized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts