Question: Problem 14-7 (algorithmic) Question Help Sunrise Manufacturing, Inc. Sunrise Manufacturing, Inc., a U.S. multinational company, has the following debt components in its consolidated capital section,

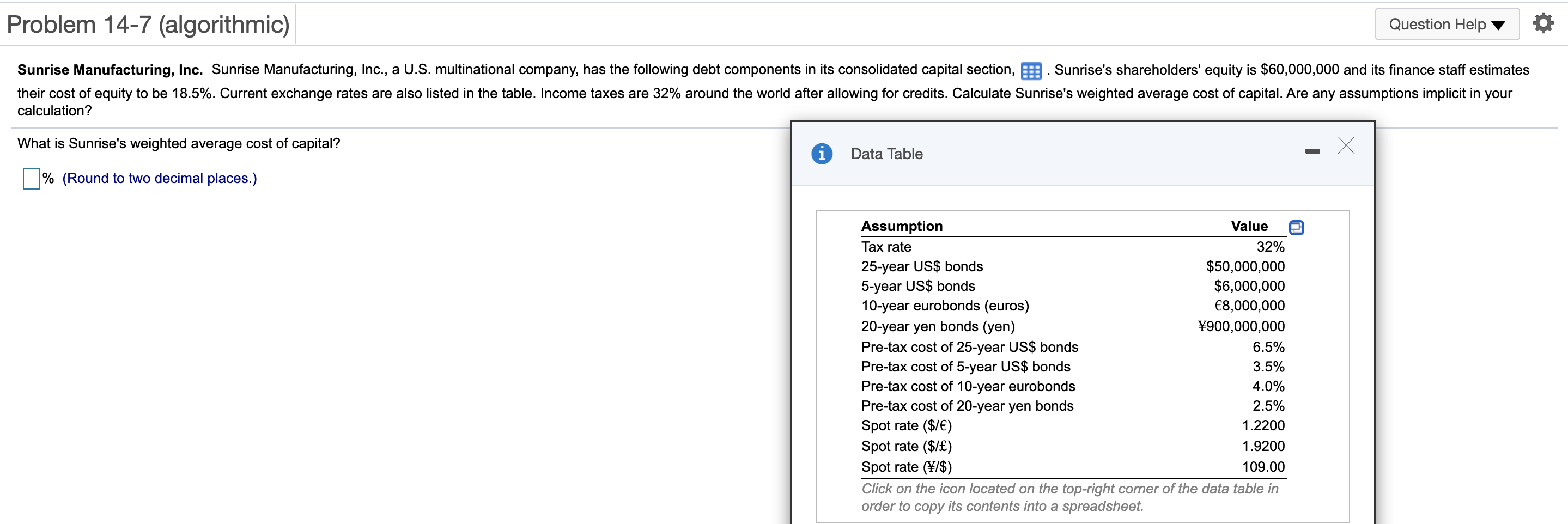

Problem 14-7 (algorithmic) Question Help Sunrise Manufacturing, Inc. Sunrise Manufacturing, Inc., a U.S. multinational company, has the following debt components in its consolidated capital section, Sunrise's shareholders' equity is $60,000,000 and its finance staff estimates their cost of equity to be 18.5%. Current exchange rates are also listed in the table. Income taxes are 32% around the world after allowing for credits. Calculate Sunrise's weighted average cost of capital. Are any assumptions implicit in your calculation? What is Sunrise's weighted average cost of capital? i X Data Table - % (Round to two decimal places.) Assumption Value Tax rate 32% 25-year US$ bonds $50,000,000 5-year US$ bonds $6,000,000 10-year eurobonds (euros) 8,000,000 20-year yen bonds (yen) 900,000,000 Pre-tax cost of 25-year US$ bonds 6.5% Pre-tax cost of 5-year US$ bonds 3.5% Pre-tax cost of 10-year eurobonds 4.0% Pre-tax cost of 20-year yen bonds 2.5% Spot rate ($/) 1.2200 Spot rate ($/) 1.9200 Spot rate (/$) 109.00 Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. Problem 14-7 (algorithmic) Question Help Sunrise Manufacturing, Inc. Sunrise Manufacturing, Inc., a U.S. multinational company, has the following debt components in its consolidated capital section, Sunrise's shareholders' equity is $60,000,000 and its finance staff estimates their cost of equity to be 18.5%. Current exchange rates are also listed in the table. Income taxes are 32% around the world after allowing for credits. Calculate Sunrise's weighted average cost of capital. Are any assumptions implicit in your calculation? What is Sunrise's weighted average cost of capital? i X Data Table - % (Round to two decimal places.) Assumption Value Tax rate 32% 25-year US$ bonds $50,000,000 5-year US$ bonds $6,000,000 10-year eurobonds (euros) 8,000,000 20-year yen bonds (yen) 900,000,000 Pre-tax cost of 25-year US$ bonds 6.5% Pre-tax cost of 5-year US$ bonds 3.5% Pre-tax cost of 10-year eurobonds 4.0% Pre-tax cost of 20-year yen bonds 2.5% Spot rate ($/) 1.2200 Spot rate ($/) 1.9200 Spot rate (/$) 109.00 Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts