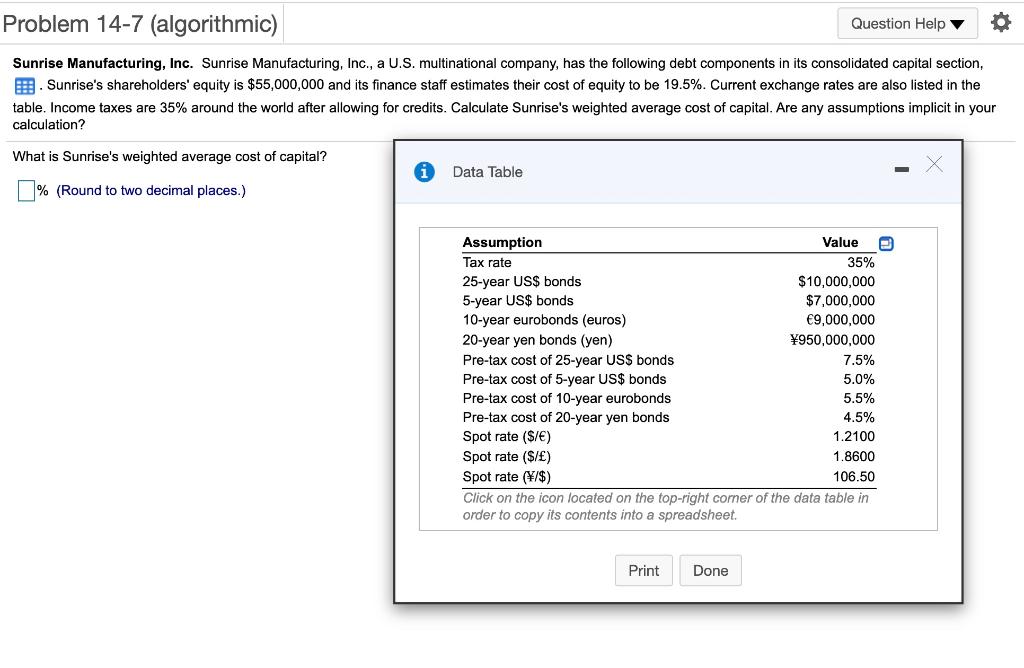

Question: Problem 14-7 (algorithmic) Question Help Sunrise Manufacturing, Inc. Sunrise Manufacturing, Inc., a U.S. multinational company, has the following debt components in its consolidated capital section,

Problem 14-7 (algorithmic) Question Help Sunrise Manufacturing, Inc. Sunrise Manufacturing, Inc., a U.S. multinational company, has the following debt components in its consolidated capital section, Sunrise's shareholders' equity is $55,000,000 and its finance staff estimates their cost of equity to be 19.5%. Current exchange rates are also listed in the table. Income taxes are 35% around the world after allowing for credits. Calculate Sunrise's weighted average cost of capital. Are any assumptions implicit in your calculation? What is Sunrise's weighted average cost of capital? Data Table % (Round to two decimal places.) Assumption Value Tax rate 35% 25-year US$ bonds $10,000,000 5-year US$ bonds $7,000,000 10-year eurobonds (euros) 9,000,000 20-year yen bonds (yen) 950,000,000 Pre-tax cost of 25-year US$ bonds 7.5% Pre-tax cost of 5-year US$ bonds 5.0% Pre-tax cost of 10-year eurobonds 5.5% Pre-tax cost of 20-year yen bonds 4.5% Spot rate ($/) 1.2100 Spot rate ($/) 1.8600 Spot rate (/$) 106.50 Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. Print Done Problem 14-7 (algorithmic) Question Help Sunrise Manufacturing, Inc. Sunrise Manufacturing, Inc., a U.S. multinational company, has the following debt components in its consolidated capital section, Sunrise's shareholders' equity is $55,000,000 and its finance staff estimates their cost of equity to be 19.5%. Current exchange rates are also listed in the table. Income taxes are 35% around the world after allowing for credits. Calculate Sunrise's weighted average cost of capital. Are any assumptions implicit in your calculation? What is Sunrise's weighted average cost of capital? Data Table % (Round to two decimal places.) Assumption Value Tax rate 35% 25-year US$ bonds $10,000,000 5-year US$ bonds $7,000,000 10-year eurobonds (euros) 9,000,000 20-year yen bonds (yen) 950,000,000 Pre-tax cost of 25-year US$ bonds 7.5% Pre-tax cost of 5-year US$ bonds 5.0% Pre-tax cost of 10-year eurobonds 5.5% Pre-tax cost of 20-year yen bonds 4.5% Spot rate ($/) 1.2100 Spot rate ($/) 1.8600 Spot rate (/$) 106.50 Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts