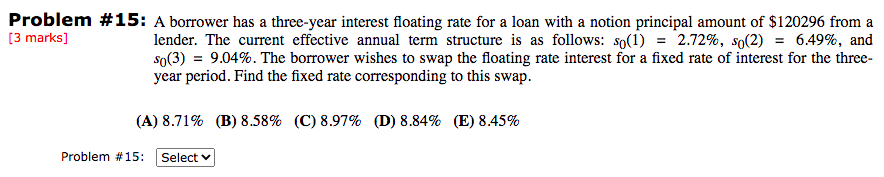

Question: Problem #15: A borrower has a three-year interest floating rate for a loan with a notion principal amount of $120296 from a [3 marks] lender.

Problem #15: A borrower has a three-year interest floating rate for a loan with a notion principal amount of $120296 from a [3 marks] lender. The current effective annual term structure is as follows: so(1) = 2.72%, so(2) = 6.49%, and so(3) = 9.04%. The borrower wishes to swap the floating rate interest for a fixed rate of interest for the three- year period. Find the fixed rate corresponding to this swap. (A) 8.71% (B) 8.58% (C) 8.97% (D) 8.84% (E) 8.45% Problem #15: Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts