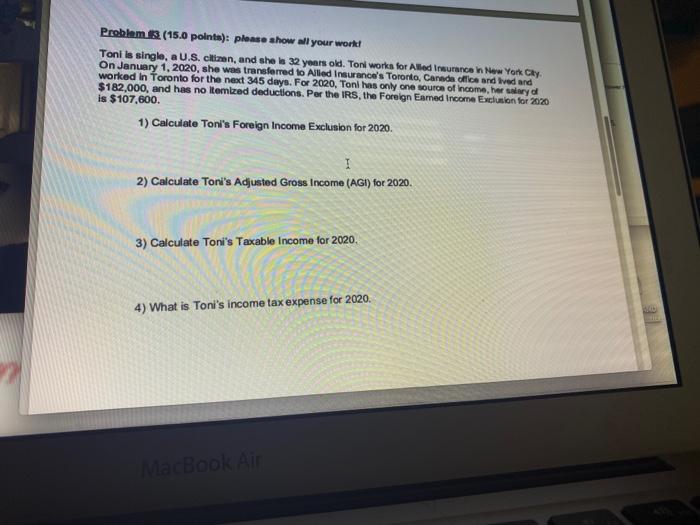

Question: Problem (15.0 points): please show all your work! Tonilis single, a U.S. citizen, and she is 32 years old. Ton works for Allied munca in

Problem (15.0 points): please show all your work! Tonilis single, a U.S. citizen, and she is 32 years old. Ton works for Allied munca in New York Cky, On January 1, 2020, she was transferred to Alled Insurance's Toronto, Canada office and ved and worked in Toronto for the next 345 days. For 2020, Toni has only one source of income, her salary $182,000, and has no Itemized deductions. Per the IRS, the Foreign Eamed Income Exclusion for 2020 is $107,600. 1) Calculate Ton's Foreign Income Exclusion for 2020. 1 2) Calculate Toni's Adjusted Gross Income (AGI) for 2020. 3) Calculate Toni's Taxable income for 2020 4) What is Toni's income tax expense for 2020. a Book Air Problem (15.0 points): please show all your work! Tonilis single, a U.S. citizen, and she is 32 years old. Ton works for Allied munca in New York Cky, On January 1, 2020, she was transferred to Alled Insurance's Toronto, Canada office and ved and worked in Toronto for the next 345 days. For 2020, Toni has only one source of income, her salary $182,000, and has no Itemized deductions. Per the IRS, the Foreign Eamed Income Exclusion for 2020 is $107,600. 1) Calculate Ton's Foreign Income Exclusion for 2020. 1 2) Calculate Toni's Adjusted Gross Income (AGI) for 2020. 3) Calculate Toni's Taxable income for 2020 4) What is Toni's income tax expense for 2020. a Book Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts