Question: Problem 15-17 Option Strategies (LO3, CFA5) You write a put with a strike price of $115 on stock that you have shorted at $115 (this

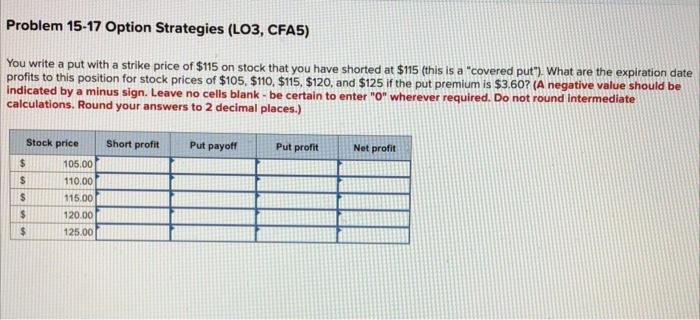

Problem 15-17 Option Strategies (LO3, CFA5) You write a put with a strike price of $115 on stock that you have shorted at $115 (this is a "covered put") What are the expiration date profits to this position for stock prices of $105, $110, $115, $120, and $125 if the put premium is $3.60? (A negative value should be indicated by a minus sign. Leave no cells blank - be certain to enter "0" wherever required. Do not round Intermediate calculations. Round your answers to 2 decimal places.) Short profit Put payoff Put profit Net profit Stock price $ 105.00 $ 110.00 $ 115.00 $ 120.00 125.00

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock