Question: Problem 15-32 (LO. 6) Fish, Inc., an exempt organization, reports unrelated business income of $500,000 (before any charitable contribution deduction). During 2022, Fish makes charitable

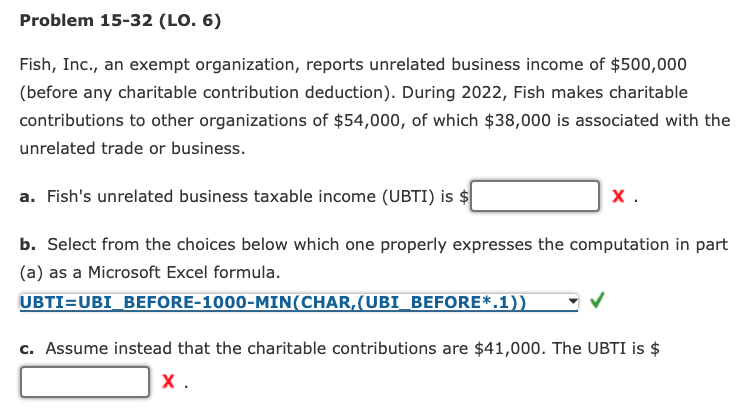

Problem 15-32 (LO. 6) Fish, Inc., an exempt organization, reports unrelated business income of $500,000 (before any charitable contribution deduction). During 2022, Fish makes charitable contributions to other organizations of $54,000, of which $38,000 is associated with the unrelated trade or business. a. Fish's unrelated business taxable income (UBTI) is $ X. b. Select from the choices below which one properly expresses the computation in part (a) as a Microsoft Excel formula. UBTI=UBI_BEFORE-1000-MIN(CHAR,(UBI_BEFORE*.1)) c. Assume instead that the charitable contributions are $41,000. The UBTI is $ X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts