Question: Problem 2 5 - 3 2 ( LO . 6 ) Fish, Inc., an exempt organization, reports unrelated business income of $ 5 0 0

Problem LO

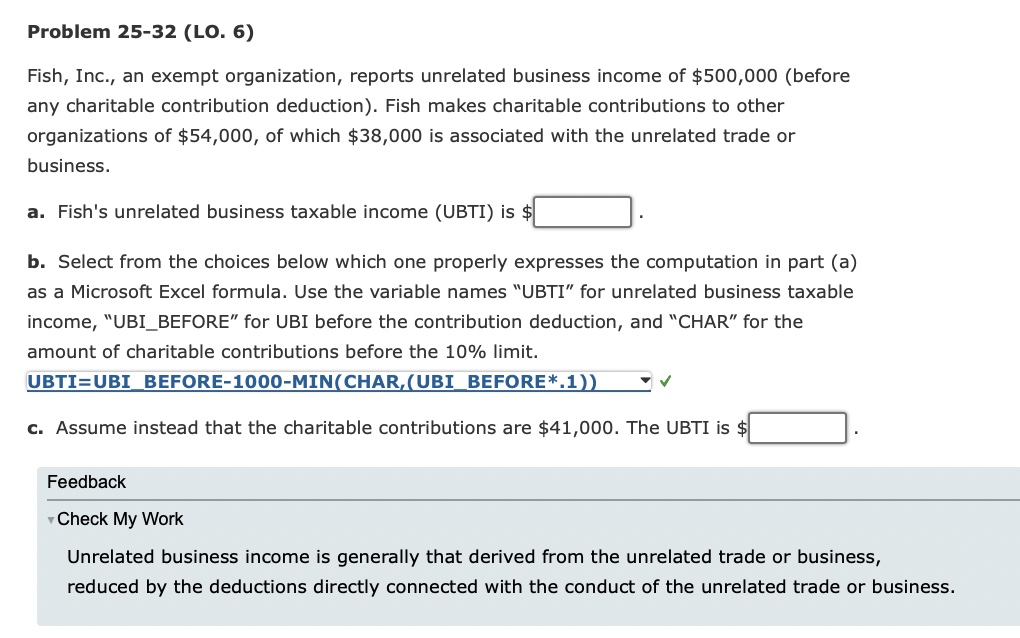

Fish, Inc., an exempt organization, reports unrelated business income of $before

any charitable contribution deduction Fish makes charitable contributions to other

organizations of $ of which $ is associated with the unrelated trade or

business.

a Fish's unrelated business taxable income UBTI is $

b Select from the choices below which one properly expresses the computation in part a

as a Microsoft Excel formula. Use the variable names "UBTI" for unrelated business taxable

income, "UBIBEFORE" for UBI before the contribution deduction, and "CHAR" for the

amount of charitable contributions before the limit

UBTIUBIBEFOREMINCHARUBIBEFORE

c Assume instead that the charitable contributions are $ The UBTI is $

Feedback

Check My Work

Unrelated business income is generally that derived from the unrelated trade or business,

reduced by the deductions directly connected with the conduct of the unrelated trade or business.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock