Question: Problem 15-36 (LO. 2) Steve owns Machine A (adjusted basis of $12,000 and fair market value of $15,000), which he uses in his business. Steve

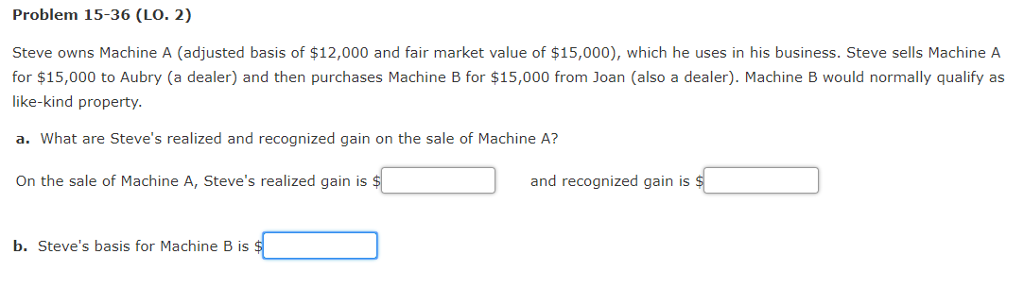

Problem 15-36 (LO. 2) Steve owns Machine A (adjusted basis of $12,000 and fair market value of $15,000), which he uses in his business. Steve sells Machine A for $15,000 to Aubry (a dealer) and then purchases Machine B for $15,000 from Joan (also a dealer). Machine B would normally qualify as like-kind property. a. What are Steve's realized and recognized gain on the sale of Machine A? On the sale of Machine A, Steve's realized gain is and recognized gain is b. Steve's basis for Machine B is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts