Question: Problem 15-36 (LO. 2) Steve owns Machine A (adjusted basis of $12,000 and fair market value of $15,000), which he uses in his business. Steve

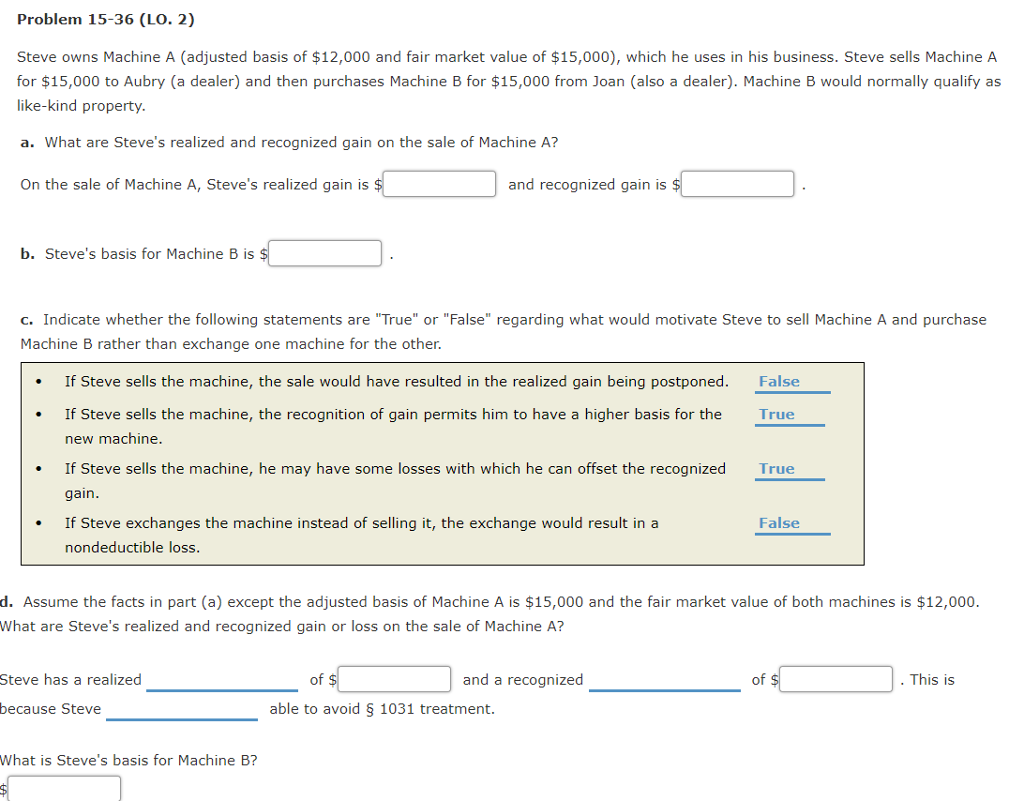

Problem 15-36 (LO. 2) Steve owns Machine A (adjusted basis of $12,000 and fair market value of $15,000), which he uses in his business. Steve sells Machine A for $15,000 to Aubry (a dealer) and then purchases Machine B for $15,000 from Joan (also a dealer). Machine B would normally qualify as like-kind property a. What are Steve's realized and recognized gain on the sale of Machine A? On the sale of Machine A, Steve's reaized gain is and recognized gain is b. Steve's basis for Machine B is c. Indicate whether the following statements are "True" or "False" regarding what would motivate Steve to sell Machine A and purchase Machine B rather than exchange one machine for the other. If Steve sells the machine, the sale would have resulted in the realized gain being postponed. False If Steve sells the machine, the recognition of gain permits him to have a higher basis for the True new machine If Steve sells the machine, he may have some losses with which he can offset the recognized True gain If Steve exchanges the machine instead of selling it, the exchange would result in a nondeductible loss False d. Assume the facts in part (a) except the adjusted basis of Machine A is $15,000 and the fair market value of both machines is $12,000 What are Steve's realized and recognized gain or loss on the sale of Machine A? Steve has a realized of and a recognized of . This is because Steve able to avoid 1031 treatment. What is Steve's basis for Machine B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts