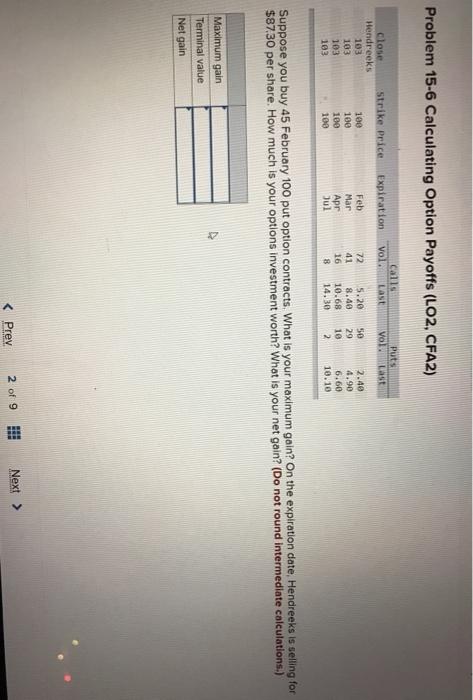

Question: Problem 15-6 Calculating Option Payoffs (LO2, CFA2) Call Vol. Last Strike Price Expiration Puts Vol. Last Close Hendreeks 103 103 103 103 100 100 100

Problem 15-6 Calculating Option Payoffs (LO2, CFA2) Call Vol. Last Strike Price Expiration Puts Vol. Last Close Hendreeks 103 103 103 103 100 100 100 100 Feb Mar Apr Jul 72 41 16 8 5.20 8.40 10.68 14.30 50 29 10 2 2.40 4.90 6.60 10.10 Suppose you buy 45 February 100 put option contracts. What is your maximum gain? On the expiration date, Hendreeks is selling for $87,30 per share. How much is your options investment worth? What is your net gain? (Do not round intermediate calculations.) Maximum gain Terminal value Net gain Prev 2 of 9 Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts