Question: problem 16 CHAPTER 4 CAPACITY PLANNING din average number of cars per day, would be as more than the plant's capacity of 120 million wallons

problem 16

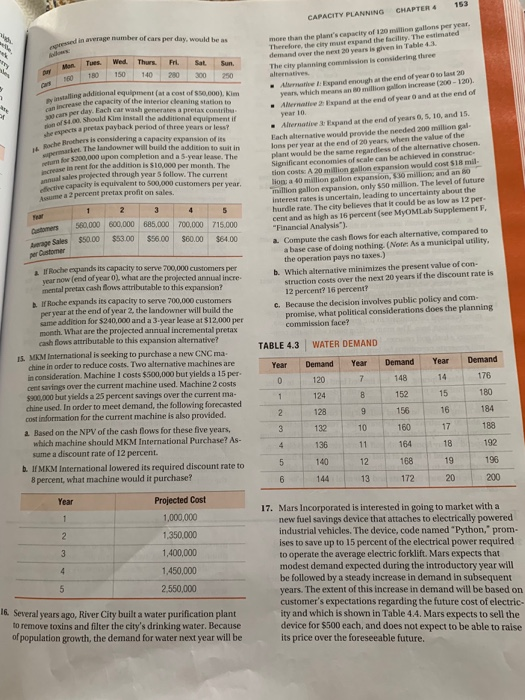

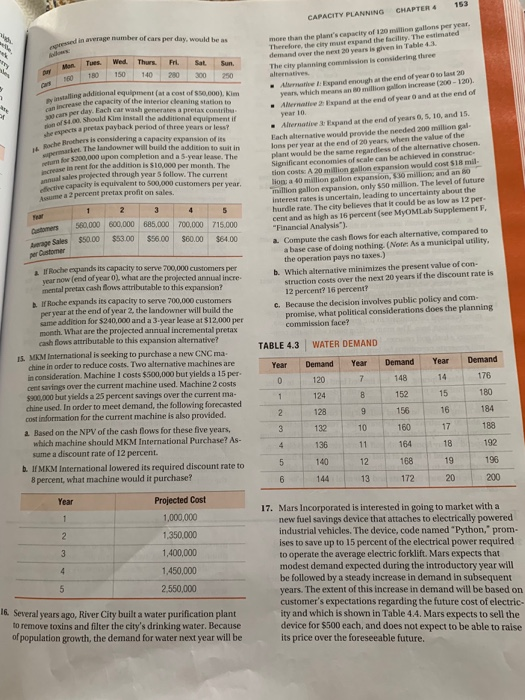

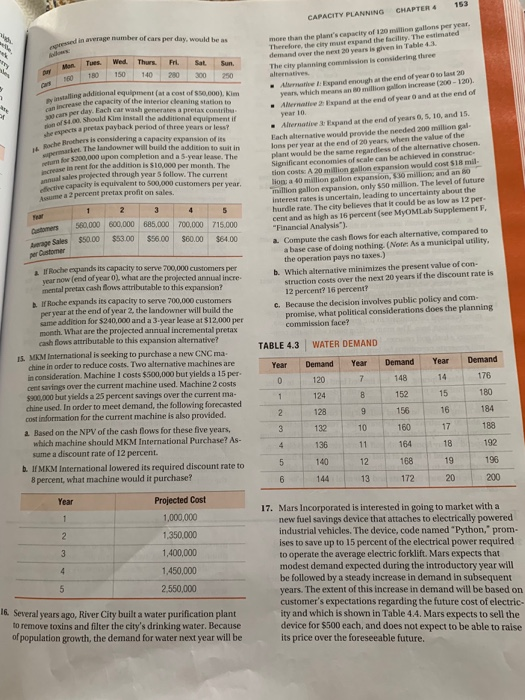

CHAPTER 4 CAPACITY PLANNING din average number of cars per day, would be as more than the plant's capacity of 120 million wallons per year. Therefore, the city is expand the facility. The estimated demand over the next 20 years is given in Table 4.3 The city planning Commission is considering three Tues. 180 Wed 150 Thu 140 Fri 200 Sat 300 Sun. 200 Trim C iling additional equipment at a cost of SS 000), Kim the capacity of the interior cleaning Station to e rday. Each car wash generates a prelax contribu 1. Should Kim install the additional equipment if experts a prax payback period of three years Brothers is considering a capacity expansion of its et The landlowe build the addition to it in 0,000 completion and a s.year The rease in rent for the addition is 10.000 per month The sales projected through year follow. The current the city is cuento Custom Decor e a 2 percent pretax profit on sales . Alma Expand enough at the end of year to last 20 years, which means an million on increase (200-120). All e Expand at the end of year and at the end of year 10 - Alternate Expand at the end of years 0, 5, 10, and 15. Each adiernative would provide the needed 200 million gal lons per year at the end of 20 years, when the value of the plant would be the same regardless of the alternative chosen. Significant economies of scale can be achieved in construc tion costs A 20 million gallon expansion would cost $18 mil- loma 10 million gallon expansion, 30 million and an 80 million gallon expansion, only $50 million. The level of future Interest rates is uncertain, leading to uncertainty about the hurdle rate. The city believes that it could be as low as 12 per cent and as high as 16 percent (see MyOMLab Supplement F. "Financial Analysis"). a. Compute the cash flows for each alternative, compared to a base case of doing nothing. (Note: As a municipal utility, the operation pays no taxes.) b. Which alternative minimizes the present value of con- struction costs over the next 20 years if the discount rate is 12 percent? 16 percent? c. Because the decision involves public policy and com- promise, what political considerations does the planning commission face? 580,000 $50.00 600,000 $5300 685,000 $56.00 700.000 $60.00 715 000 $64.00 Sales TABLE 4.3 WATER DEMAND Year Demand Year Year Demand of Roche grands its capacity to serve 700,000 customers per war now end of year what are the projected annual incre. mental pretax cash flows attributable to this expansion? Roche expands its capacity to serve 700,000 customers pervear at the end of year 2, the landowner will build the some addition for $240,000 and a 3-year lease at $12.000 per month. What are the projected annual incremental pretax cash flows attributable to this expansion alternative? 15. MKM International is seeking to purchase a new CNC ma. chine in order to reduce costs. Two alternative machines are in consideration Machine I costs $500,000 but yields a 15 per Gentings over the current machine used. Machine 2 costs $900.000 but yields a 25 percent savings over the current ma- chine used. In order to meet demand, the following forecasted cost information for the current machine is also provided. 2. Based on the NPV of the cash flows for these five years, which machine should MKM International Purchase? As- sume a discount rate of 12 percent. b. If MKM International lowered its required discount rate to 8 percent, what machine would it purchase? Demand 148 152 180 128 = 144 172 20 200 Year 2 Projected Cost 1,000,000 1,350,000 1,400,000 1.450,000 2.550,000 17. Mars Incorporated is interested in going to market with a new fuel savings device that attaches to electrically powered industrial vehicles. The device, code named "Python, prom- ises to save up to 15 percent of the electrical power required to operate the average electric forklift. Mars expects that modest demand expected during the introductory year will be followed by a steady increase in demand in subsequent years. The extent of this increase in demand will be based on customer's expectations regarding the future cost of electric- ity and which is shown in Table 44. Mars expects to sell the device for $500 each, and does not expect to be able to raise its price over the foreseeable future. 16. Several years ago, River City built a water purification plant to remove toxins and filter the city's drinking water. Because of population growth, the demand for water next year will be CHAPTER 4 CAPACITY PLANNING din average number of cars per day, would be as more than the plant's capacity of 120 million wallons per year. Therefore, the city is expand the facility. The estimated demand over the next 20 years is given in Table 4.3 The city planning Commission is considering three Tues. 180 Wed 150 Thu 140 Fri 200 Sat 300 Sun. 200 Trim C iling additional equipment at a cost of SS 000), Kim the capacity of the interior cleaning Station to e rday. Each car wash generates a prelax contribu 1. Should Kim install the additional equipment if experts a prax payback period of three years Brothers is considering a capacity expansion of its et The landlowe build the addition to it in 0,000 completion and a s.year The rease in rent for the addition is 10.000 per month The sales projected through year follow. The current the city is cuento Custom Decor e a 2 percent pretax profit on sales . Alma Expand enough at the end of year to last 20 years, which means an million on increase (200-120). All e Expand at the end of year and at the end of year 10 - Alternate Expand at the end of years 0, 5, 10, and 15. Each adiernative would provide the needed 200 million gal lons per year at the end of 20 years, when the value of the plant would be the same regardless of the alternative chosen. Significant economies of scale can be achieved in construc tion costs A 20 million gallon expansion would cost $18 mil- loma 10 million gallon expansion, 30 million and an 80 million gallon expansion, only $50 million. The level of future Interest rates is uncertain, leading to uncertainty about the hurdle rate. The city believes that it could be as low as 12 per cent and as high as 16 percent (see MyOMLab Supplement F. "Financial Analysis"). a. Compute the cash flows for each alternative, compared to a base case of doing nothing. (Note: As a municipal utility, the operation pays no taxes.) b. Which alternative minimizes the present value of con- struction costs over the next 20 years if the discount rate is 12 percent? 16 percent? c. Because the decision involves public policy and com- promise, what political considerations does the planning commission face? 580,000 $50.00 600,000 $5300 685,000 $56.00 700.000 $60.00 715 000 $64.00 Sales TABLE 4.3 WATER DEMAND Year Demand Year Year Demand of Roche grands its capacity to serve 700,000 customers per war now end of year what are the projected annual incre. mental pretax cash flows attributable to this expansion? Roche expands its capacity to serve 700,000 customers pervear at the end of year 2, the landowner will build the some addition for $240,000 and a 3-year lease at $12.000 per month. What are the projected annual incremental pretax cash flows attributable to this expansion alternative? 15. MKM International is seeking to purchase a new CNC ma. chine in order to reduce costs. Two alternative machines are in consideration Machine I costs $500,000 but yields a 15 per Gentings over the current machine used. Machine 2 costs $900.000 but yields a 25 percent savings over the current ma- chine used. In order to meet demand, the following forecasted cost information for the current machine is also provided. 2. Based on the NPV of the cash flows for these five years, which machine should MKM International Purchase? As- sume a discount rate of 12 percent. b. If MKM International lowered its required discount rate to 8 percent, what machine would it purchase? Demand 148 152 180 128 = 144 172 20 200 Year 2 Projected Cost 1,000,000 1,350,000 1,400,000 1.450,000 2.550,000 17. Mars Incorporated is interested in going to market with a new fuel savings device that attaches to electrically powered industrial vehicles. The device, code named "Python, prom- ises to save up to 15 percent of the electrical power required to operate the average electric forklift. Mars expects that modest demand expected during the introductory year will be followed by a steady increase in demand in subsequent years. The extent of this increase in demand will be based on customer's expectations regarding the future cost of electric- ity and which is shown in Table 44. Mars expects to sell the device for $500 each, and does not expect to be able to raise its price over the foreseeable future. 16. Several years ago, River City built a water purification plant to remove toxins and filter the city's drinking water. Because of population growth, the demand for water next year will be