Question: Problem 16-3: Multiple Choice Accounting for contributions Use the following information for the next seven questions: Budoy Organization, a non-profit organization, received the following donations

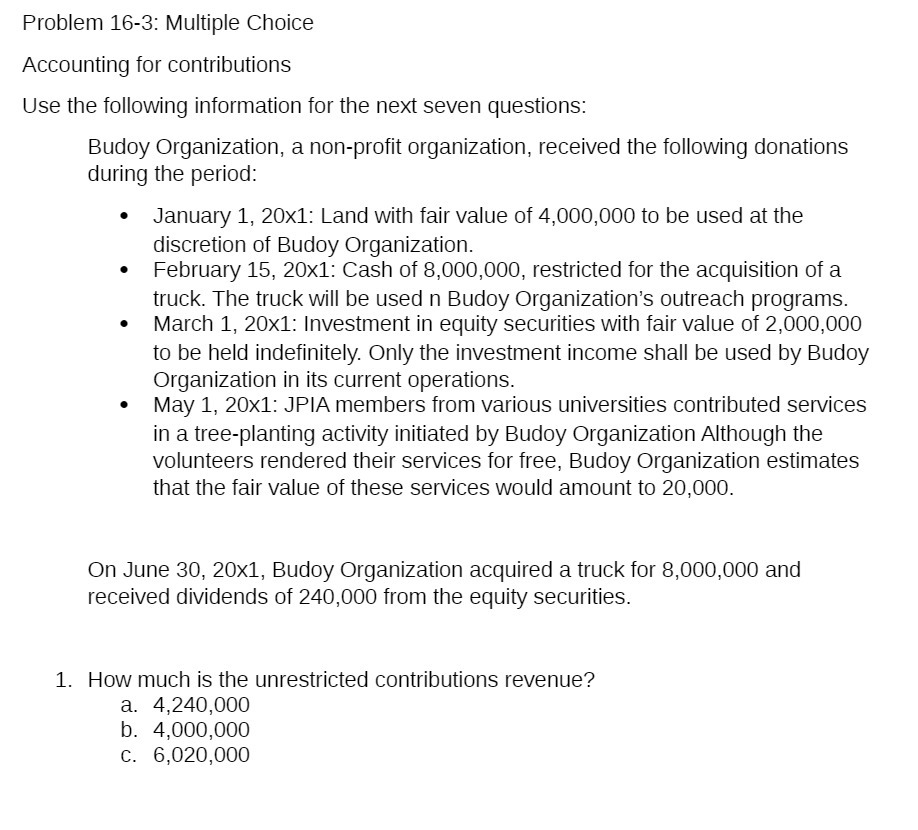

Problem 16-3: Multiple Choice Accounting for contributions Use the following information for the next seven questions: Budoy Organization, a non-profit organization, received the following donations during the period: January 1, 20x1: Land with fair value of 4,000,000 to be used at the discretion of Budoy Organization. February 15, 20x1: Cash of 8,000,000, restricted for the acquisition of a truck. The truck will be used It Budoy Organization's outreach programs. March 1, 20x1: Investment in equity securities with fair value of 2,000,000 to be held indefinitely. Only the investment income shall be used by Budoy Organization in its current operations. May 1, 20x1: JPIA members from various universities contributed services in a tree-planting activity initiated by Budoy Organization Although the volunteers rendered their services for free, Budoy Organization estimates that the fair value of these services would amount to 20,000. On June 30, 20x1, Budoy Organization acquired atruck for 8,000,000 and received dividends of 240,000 from the equity securities. 1. How much is the unrestricted contributions revenue? a. 4,240,000 b. 4,000,000 c. 6,020,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts