Question: Problem 17-7. Happydale Derivatives Traders has a portfolio (net position) in derivatives on popularly traded Zackmar common stock. The firm's managers have already engaged in

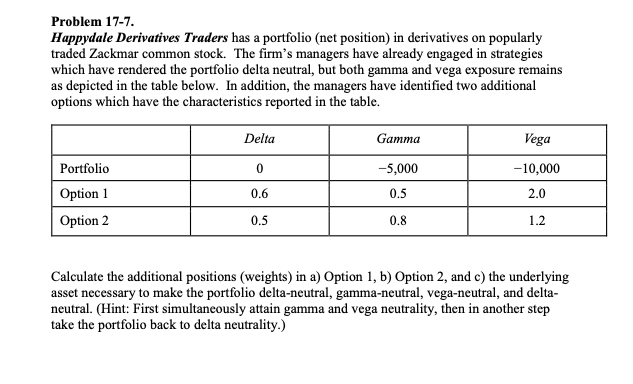

Problem 17-7. Happydale Derivatives Traders has a portfolio (net position) in derivatives on popularly traded Zackmar common stock. The firm's managers have already engaged in strategies which have rendered the portfolio delta neutral, but both gamma and vega exposure remains as depicted in the table below. In addition, the managers have identified two additional options which have the characteristics reported in the table. Delta Gamma Vega -10,000 0 -5,000 Portfolio Option 1 Option 2 0.6 0.5 2.0 0.5 0.8 1.2 Calculate the additional positions (weights) in a) Option 1, b) Option 2, and c) the underlying asset necessary to make the portfolio delta-neutral, gamma-neutral, vega-neutral, and delta- neutral. (Hint: First simultaneously attain gamma and vega neutrality, then in another step take the portfolio back to delta neutrality.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts