Question: (Problem 17.8 from Textbook) A person at age 30 is planning for retirement at age 60. He projects that he will need $100,000 a year,

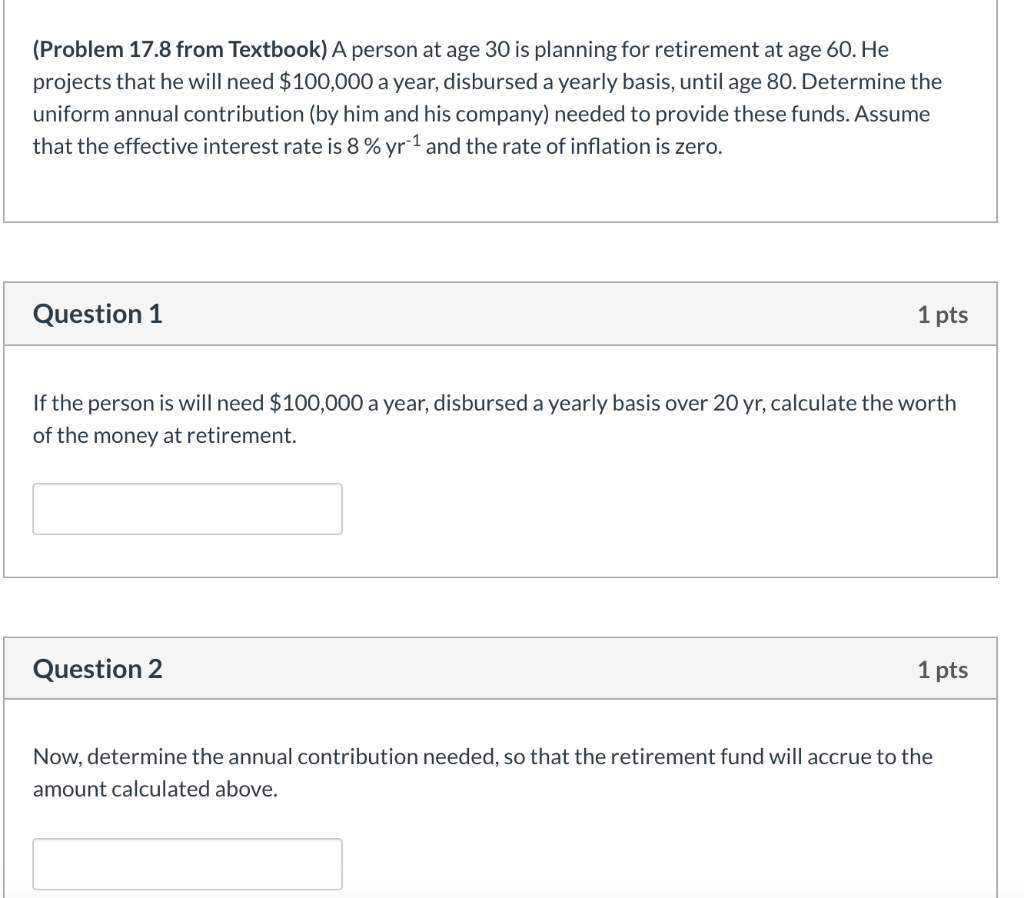

(Problem 17.8 from Textbook) A person at age 30 is planning for retirement at age 60. He projects that he will need $100,000 a year, disbursed a yearly basis, until age 80. Determine the uniform annual contribution (by him and his company) needed to provide these funds. Assume that the effective interest rate is 8 % yr-1 and the rate of inflation is zero. Question 1 1 pts If the person is will need $100,000 a year, disbursed a yearly basis over 20 yr, calculate the worth of the money at retirement. Question 2 1 pts Now, determine the annual contribution needed, so that the retirement fund will accrue to the amount calculated above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock