Question: Problem 18-02 An analyst wants to evaluate Portfolio X, consisting entirely of U.S.common stocks, using both the Treynor and Sharpe measures of portfolio performance. The

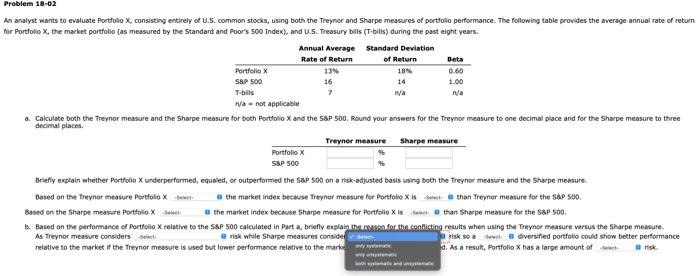

Problem 18-02 An analyst wants to evaluate Portfolio X, consisting entirely of U.S.common stocks, using both the Treynor and Sharpe measures of portfolio performance. The following table provides the average annual rate of return for Portfolio X, the market portfolio (as measured by the Standard and Poor's 500 Index), and U.S. Treasury bills (T-bills) during the past eight years. Annual Average Standard Deviation Rate of Return of Return Beta Portfolio 13% 18% 0.66 S&P 500 16 14 1.00 T-bills Iva wa wa - not applicable a. Calculate both the Treynor measure and the Sharpe measure for both Portfolio X and the S&P 500. Round your answers for the Treynor measure to one decimal place and for the Sharpe measure to three decimal places. Treyner measure Sharpe measure Portfolio X S&P 500 Briefly explain whether Portfolio X underperformed, equaled, er outperformed the S&P 500 on a risk adjusted basis using both the Treynor measure and the Sharpe measure. Based on the Treynor measure Portfolio Xe the market index because Treynor measure for Portfolio X than Trenor measure for the S&P 500. Based on the Sharpe measure Portfolio X the market index because Sharpe measure for Portfolio X is than Sharpe measure for the S&P soo. Based on the performance of Portfolio X relative to the S&P 500 calculated in Parta, briefly explain the reason for the conflicting results when using the Treynor measure versus the Sharpe measure As Treynor measure considers risk while Sharpe measures consider sks diversified portfolio could show better performance relative to the market if the Treynor measure is used but lower performance relative to the markey d. As a result, Portfolio X has a large amount of a sk wy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts