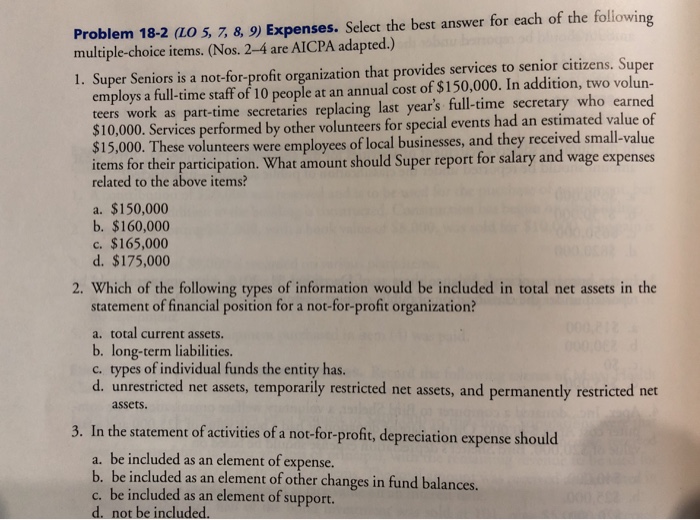

Question: Problem 18-2 (LO 5, 7, 8, 9) Expenses. Select the best answer for each of the following 1. Super Seniors is a not-for-profit organization that

Problem 18-2 (LO 5, 7, 8, 9) Expenses. Select the best answer for each of the following 1. Super Seniors is a not-for-profit organization that provides services to senior citizens. Super as part-time secretaries replacing last year's full-time secretary who earned ese volunteers were employees of local businesses, and they received small-value multiple-choice items. (Nos. 2-4 are AICPA adapted.) employs a full-time staff of 10 people at an annual cost of $150,000. In addition, two volun- $10,000. Services performed by other volunteers for special events had an estimated value of $15,000. Th items for their participation. What amount should Super report for salary and wage expenses related to the above items? a. $150,000 b. $160,000 c. $165,000 d. $175,000 2. Which of the following types of information would be included in total net assets in the statement of financial position for a not-for-profit organization? a. total current assets. b. long-term liabilities. types of individual funds the entity has. d. unrestricted net assets, temporarily restricted net assets, and permanently restricted net c. assets. 3. In the statement of activities of a not-for-profit, depreciation expense should a. be included as an element of expense. b. be included as an element of other changes in fund balances. c. be included as an element of support. d. not be included

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts