Question: Problem 18.4A Computing depreciation and MACRS on assets. LO 18-2, 18-3 On January 12, 2019, Mosley Company purchased a computer (cost, $8,200; expected life, five

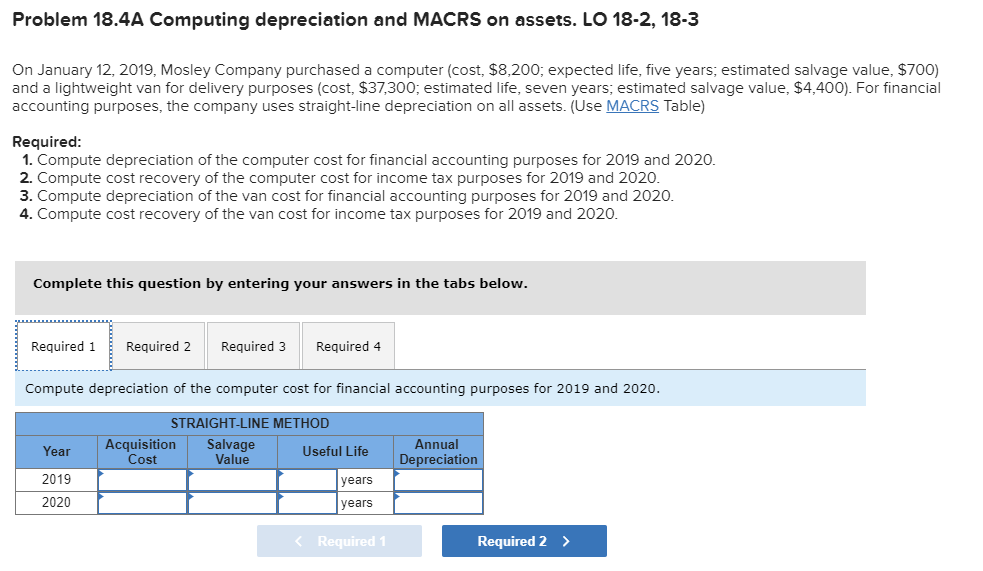

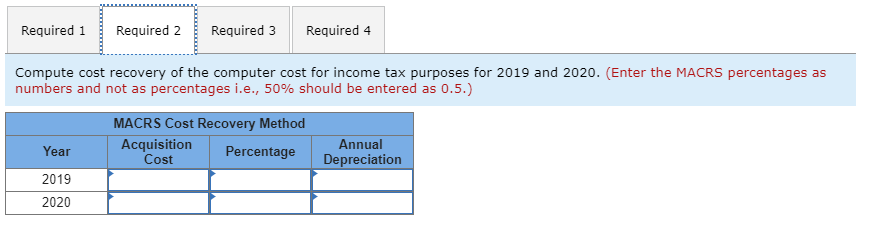

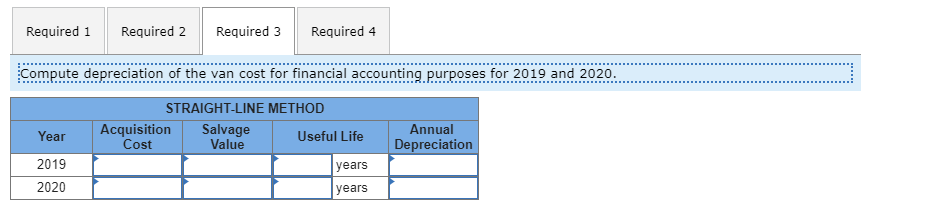

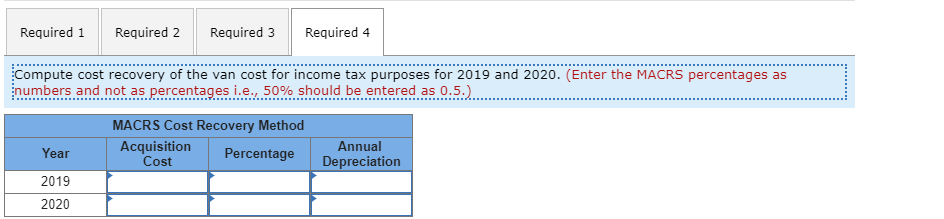

Problem 18.4A Computing depreciation and MACRS on assets. LO 18-2, 18-3 On January 12, 2019, Mosley Company purchased a computer (cost, $8,200; expected life, five years; estimated salvage value, $700) and a lightweight van for delivery purposes (cost, $37,300; estimated life, seven years; estimated salvage value, $4,400). For financial accounting purposes, the company uses straight-line depreciation on all assets. (Use MACRS Table) Required: 1. Compute depreciation of the computer cost for financial accounting purposes for 2019 and 2020. 2. Compute cost recovery of the computer cost for income tax purposes for 2019 and 2020. 3. Compute depreciation of the van cost for financial accounting purposes for 2019 and 2020. 4. Compute cost recovery of the van cost for income tax purposes for 2019 and 2020. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute depreciation of the computer cost for financial accounting purposes for 2019 and 2020. STRAIGHT-LINE METHOD Salvage Value Acquisition Cost Annual Year Useful Life Depreciation 2019 years 2020 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts