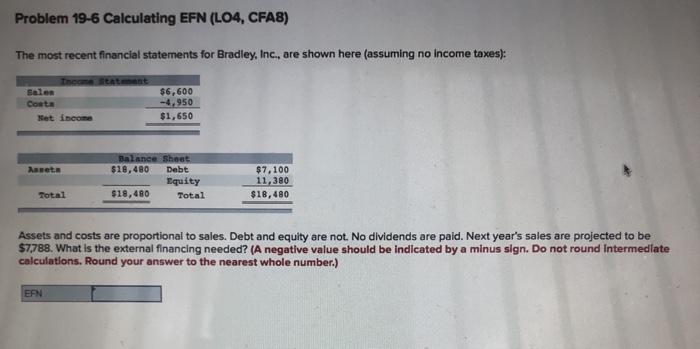

Question: Problem 19-6 Calculating EFN (L04, CFA8) The most recent financial statements for Bradley, Inc., are shown here (assuming no Income taxes): Themeftatant Sales Conta Ket

Problem 19-6 Calculating EFN (L04, CFA8) The most recent financial statements for Bradley, Inc., are shown here (assuming no Income taxes): Themeftatant Sales Conta Ket income $6,600 -4,950 $1,650 havet Balance Sheet $16,480 Debt Equity $18,480 Total $7.100 11,380 $18,480 Total Assets and costs are proportional to sales. Debt and equity are not. No dividends are paid. Next year's sales are projected to be $7,788. What is the external financing needed? (A negative value should be indicated by a minus sign. Do not round Intermediate calculations. Round your answer to the nearest whole number.) EAN

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock